Mileage Chart For Taxes

The Mileage Calculator can be used for both personal and company car mileage.

Mileage chart for taxes. Step 1 Select your tax year. 18 cents per mile was 16 cents in 2021 Charity. 16 centsmile for travel or medical mileage reduced to 17 centsmile since these three years.

IRS Standard Mileage Rates. So the new standard mileage reimbursement rates for the use of a car also vans pickups or panel trucks from on January 1 2021 will be. 18 cents per mile traveled for medical reasons or moving purposes.

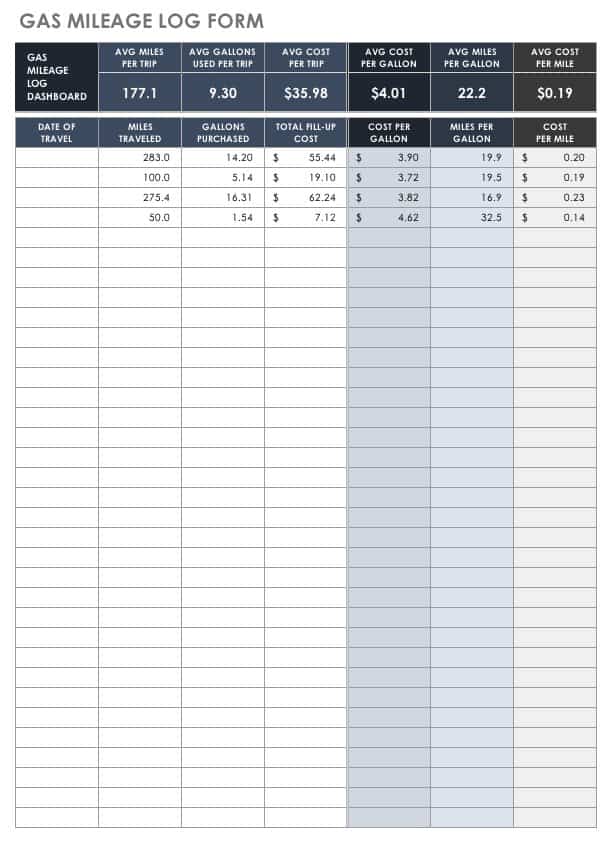

The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. Vertex42s Business Mileage Tracker will help you keep good records and determine total mileage for. The year 2021 the typical mileage rates are.

Rates per business mile. The standard mileage rates for 2022 are as follows. Drivers need to calculate it for each stateprovince for every quarter as the IFTA tax rate varies for jurisdictions and time.

Those traveled for medical charitable or moving. Step 3 Optionally enter your miles driven for moving charitable or medical purposes. Mileage Reimbursement Calculator instructions.

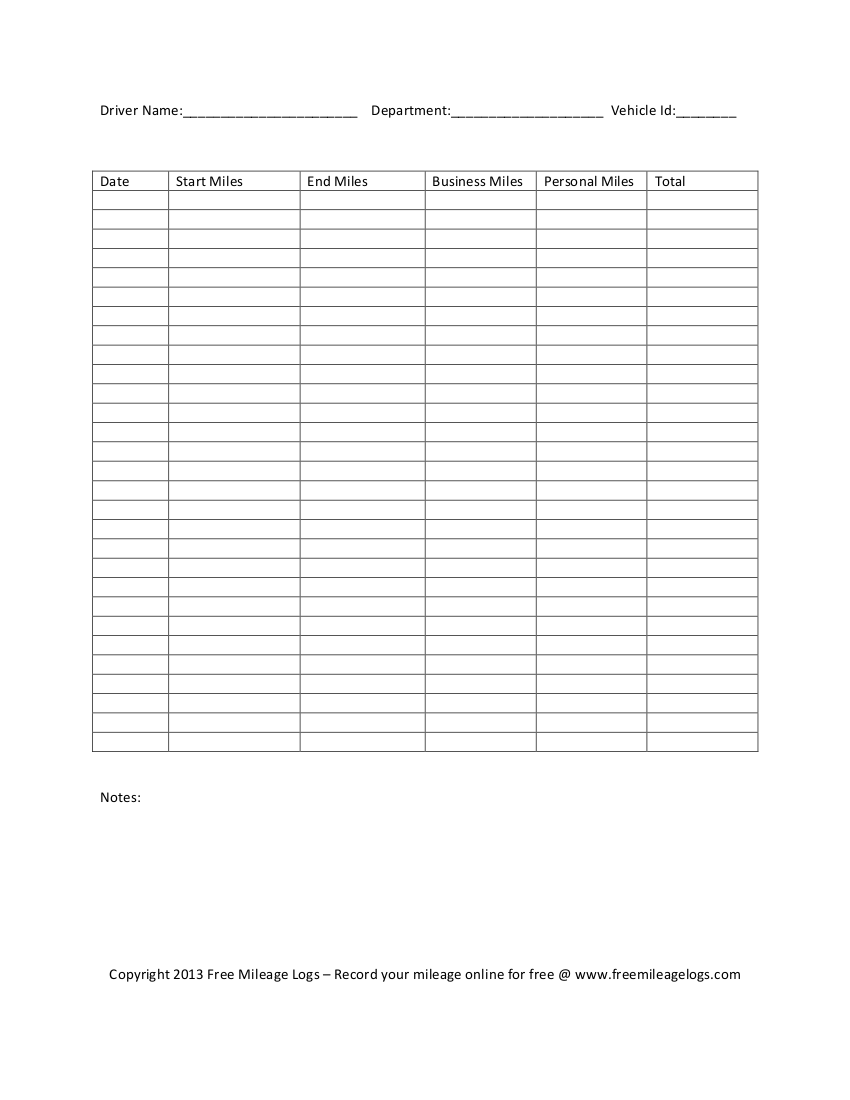

A mileage log serves as proof and may also be used to keep track of other deductible miles eg. MileIQ is a free mileage tracking app that uses GPS-backed drive-detection technology to automatically log and track miles and calculate the value of your drives for taxes or reimbursements. The IFTA mileage is calculated with the following formula.

585 cents per mile was 56 cents in 2021 Medical Moving. 14 cents per mile. The standard mileage rates for 2018 are as follows.

545 cents per mile for business-related mileage. Rates in cents per mile. 14 rows Standard Mileage Rates.

A mileage log is a record of your vehicle miles traveled for business over a particular period kept in a spreadsheet form logbook or online application that you use to claim a tax deduction or collect reimbursement from your employer. I Fuel Mileage Total gallons of fuel Total Mileage ii Fuel Usage Fuel Mileage x Miles Driven iii Fuel Tax Required Fuel Usage for x Tax Rate. 2022 Standard Mileage Rates.

2022 IRS Mileage Rate Chart IRS Mileage Rate 2022 The mileage reimbursement plan offered by the business that employs you can benefit both you and the company. This free calculator estimates the number of driving miles between two locations in the United States and also provides written directions. Whether you choose Standard Mileage Rate or Actual Expenses Method MileageWise ensures that your Mileage logs meet Every Expectation.

1 The standard mileage rate is the amount you can deduct based on miles driven rather than your actual vehicle expenses. Is there an app to track business mileage. The chart above shows the standard IRS mileage rates for tax years 2020 and 2021.

Whether youre an employee or a business owner its important to keep good business mileage records so that you have the information you need for either completing your companys mileage reimbursement form or for determining the mileage deduction on your tax return. Its not yet be possible to compare the mileage reimbursement rates of 2021 and 2022 because these rates 2022 arent yet announced. The IRS Mileage Reimbursement Rate 2021 2022.

It does not matter if. Keeping a Vehicle Mileage Log on Paper can take up 3-5 hrs of your TimeMonth. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

The high mileage chart is determined by the South Carolina Department of Revenue. 14 cents per mile. But there are lots of small-scale business owners who are yet to understand the specifics of operation the program.

Use this in conjunction with the gas mileage calculator to plan the gas cost of a road trip or explore hundreds of other calculators addressing health finance math fitness and more. Use our Company Mileage Reimbursement Calculator to see how much you can save in a Tax Year. 56 centsmile for company miles reduced from 575 centsmile in the previous year.

Remember that paying taxes is necessary and every part of it counts especially when youre filing to claim deductions from administration. IRS or Internal Revenue Service issues tax forms for taxpayers and others. The rates of reimbursement for mileage established by IRS in 2021 are.

Go With The Smartest Solution. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent. Step 2 Enter your miles driven for business purposes.