Put Call Ratio Chart

The put-call ratio has long been viewed as an indicator.

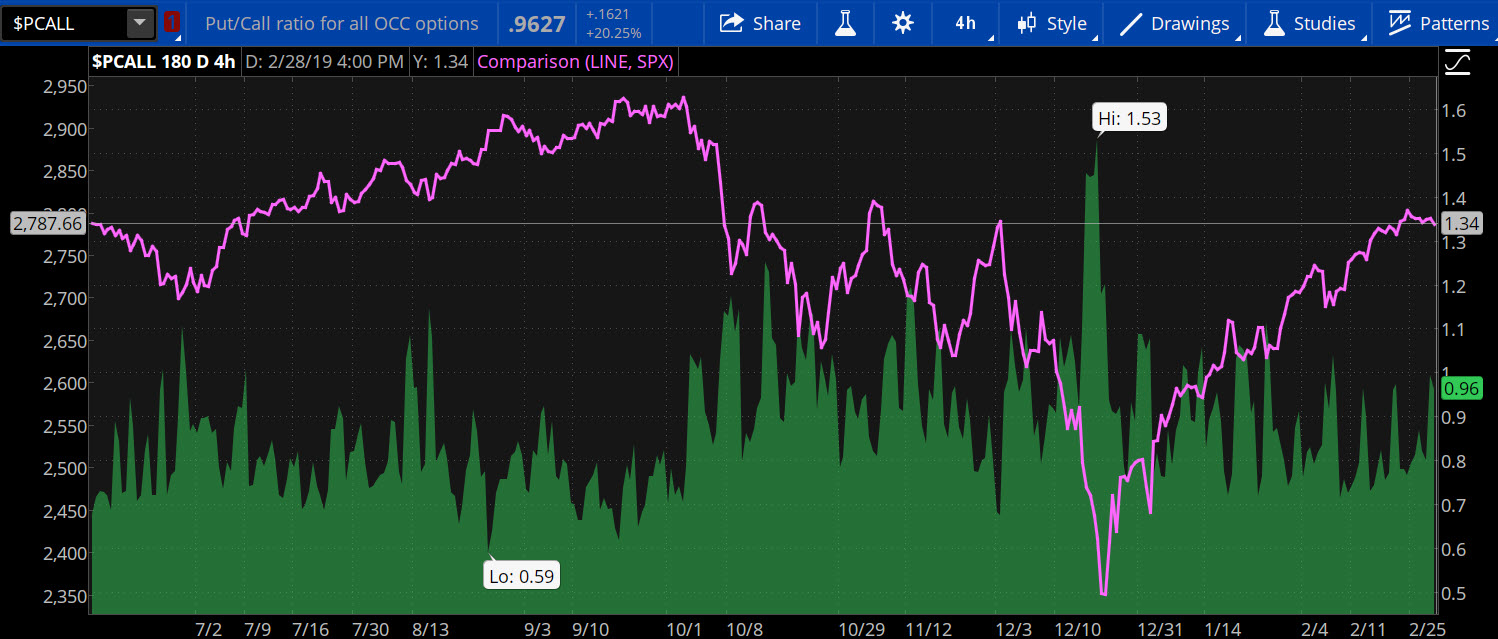

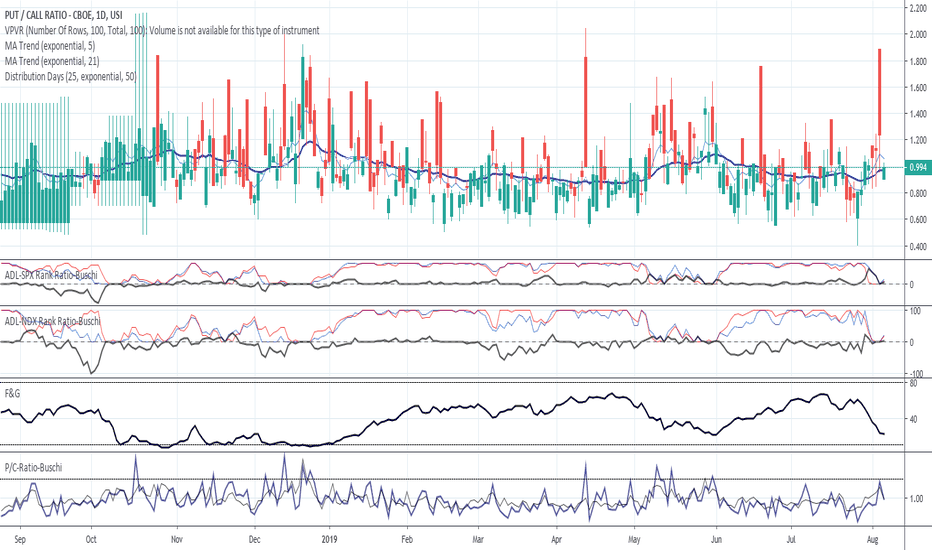

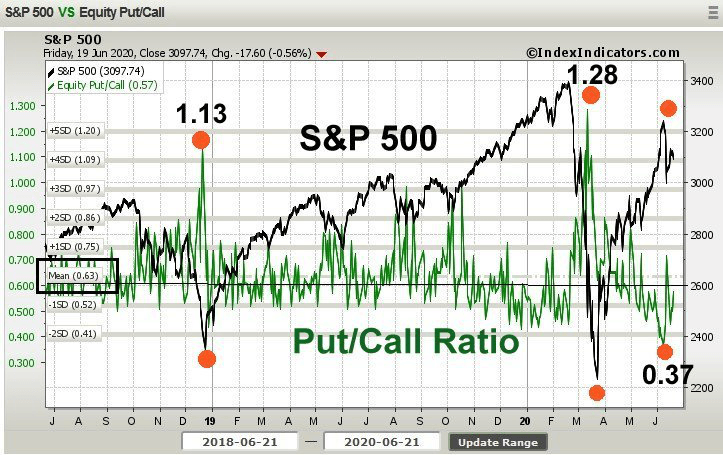

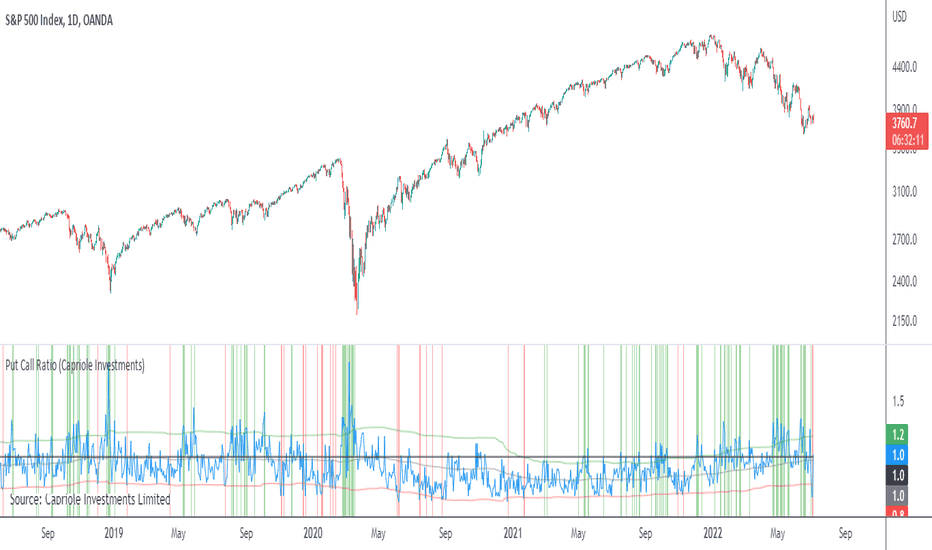

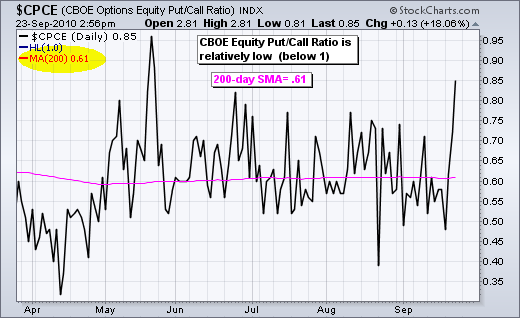

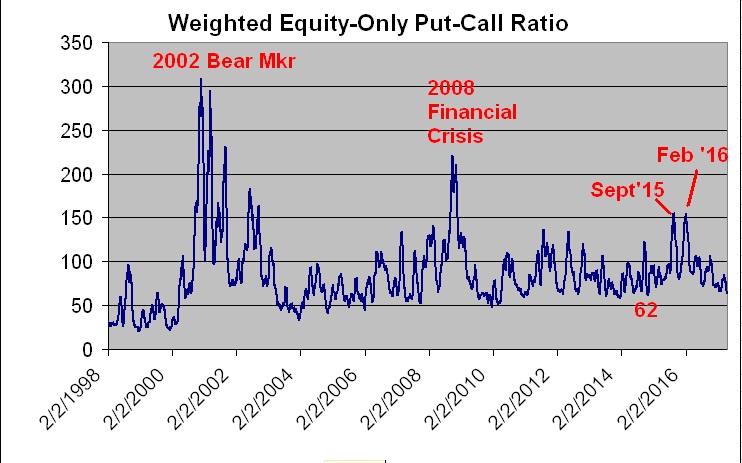

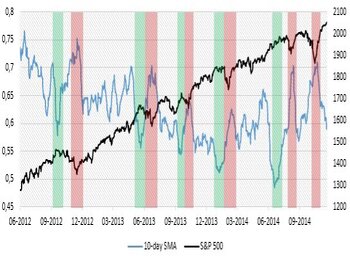

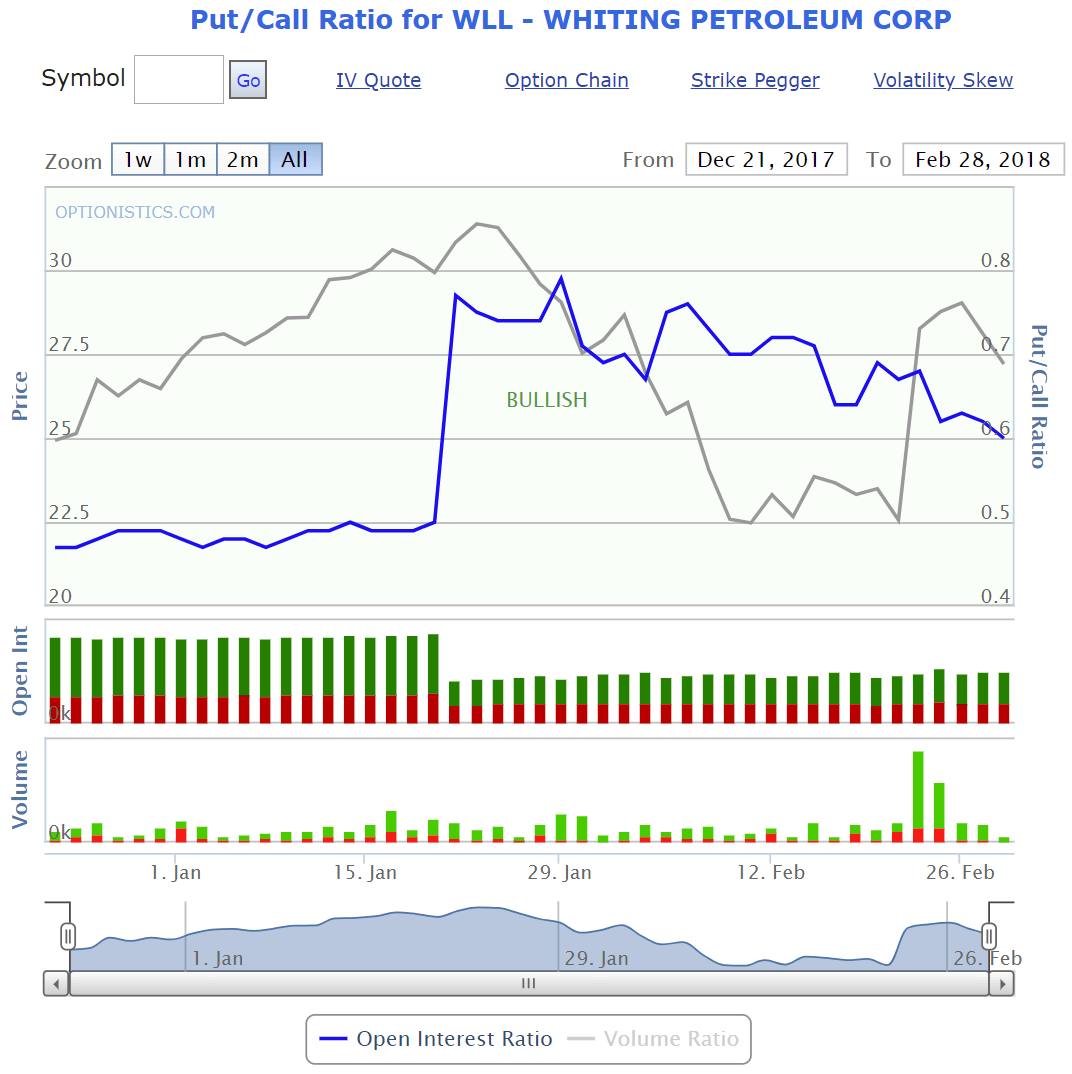

Put call ratio chart. An investor is looking to use the put-call ratio as a preliminary measure of sentiment on a security Public Securities Public securities or marketable securities are investments that are openly or easily traded in a market. View live and historical Put Call Ratio chart for nifty and banknifty options. This chart shows the historical relationship between the CrystalBull Put-Call Ratio Timing Indicator and the Put-Call Ratio along with the SP 500.

The PutCall Ratio is an indicator that shows put volume relative to call volume. NIFTY 0 1 2 3 4 5 6 PUT OI CALL OI. The Volume numbers reflect options traded during the current session.

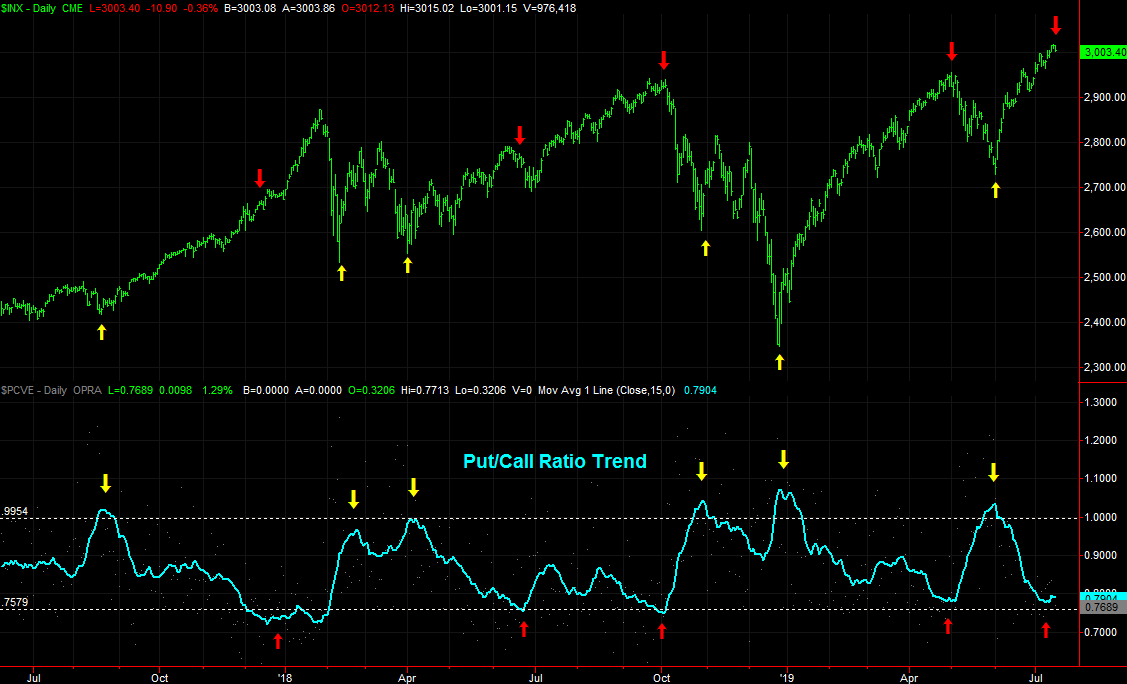

1200 AM 1200 AM 1200 AM 1200 AM 1200 AM 1200 AM 0 1 2 3 4 5 6 0 1 2 3 4 5 6 PCR NIFTY 50. Bloomberg the Company Its Products The Quint. When the put-call ratio is greater than one the number of outstanding put contracts exceeds call contracts and is typically seen as bearish.

Click on the stock symbol below to see Open Interest Max Pain Chart Live. We combine Bloombergs global leadership in business and financial news and data with. A reading above 10 indicates that options traders are purchasing more Puts than Calls in anticipation of the market falling in the near.

Call Open Interest Total 1596696. Put Call Ratio is generally viewed to know the trader sentiments in the options market. PutCall Volume Ratio 201.

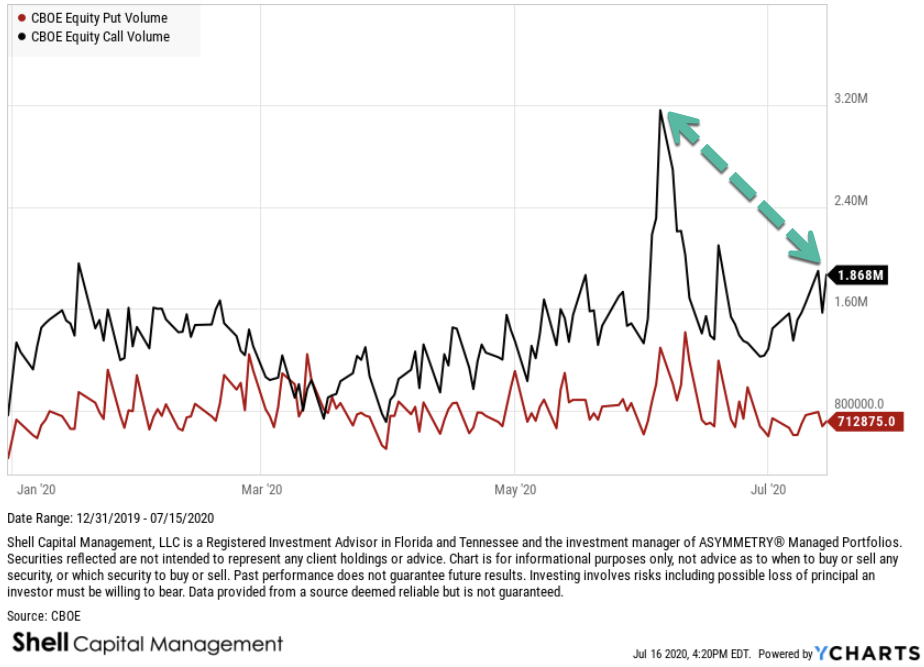

CBOE Equity PutCall Ratio is at a current level of 047 NA from the previous market day and up from 037 one year ago. Bloomberg Quint is a multiplatform Indian business and financial news company. Since the outcome is less than 1 it indicates that investors are buying more call options when compared to put options.

The PutCall Ratio PCR is an indicator that plots put volume divided by call volume. Conversely a put call ratio. The put-call ratio is an indicator ratio that provides information about the trading volume of put options to call options.

Put Open Interest Total 3260344. It specifies the ratio of traded sales options to purchase options. The put call ratio can be an indicator of investor sentiment for a stock index or the entire stock market.

Put Volume Total 582002. On the other hand if purchase of options predominate this indicates. Put Call Ratio Chart.

The security showed the following puts and calls initiated over the more. PCR Total put open interest Total call open interest. The PutCall Ratio is a measure of bearish or bullish sentiment in the market.

The securities are either equity or debt-based. It further symbolises that investors are forecasting a bullish trend in future. The calculation is straightforward and simple.

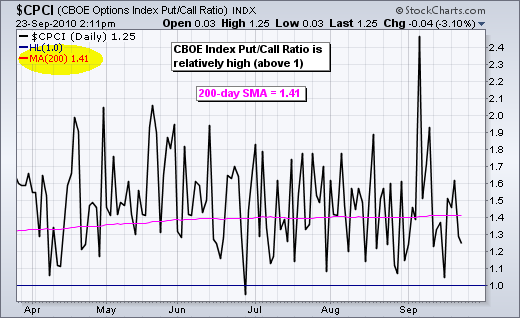

NIFTY DAILY PUT CALL RATIO PCR TREND. They can be used if you expect a decline. For best reflection of the Cboes data which is shown in 30 minutes intervals a 30.

Put options are used to. The put to call ratio or PCR is one of the timing and sentiment indicators for the valuation of securities in options trading. This is a change of NA from the previous market day and 2703 from one year ago.

NiftyNSE Put Call Ratio - Live and latest updates on NSENifty Put Call Ratio Most Active Calls Most Active Puts on BloombergQuint. Call Volume Total 289303. CBOE Daily Market Statistics.

PutCall Open Interest Ratio 204. 3 rows Put Call Ratio Put Call Ratio. 192 rows Put Call Ratio Put Call Ratio.

Example of the Put-Call Ratio. If options sales dominate the prevailing view is that this indicates a negative market sentiment stock market sentiment. PCR itself is a vast topic but in short high PCR values can indicate increase in put contracts and hence bullishness and vice versa.

Live Option Interest Chart.

/dotdash_Final_Forecasting_Market_Direction_With_Put-Call_Ratios_Nov_2020-01-4e7625ce7f2945f98ae81546e6611823.jpg)

/dotdash_Final_Forecasting_Market_Direction_With_Put-Call_Ratios_Nov_2020-01-4e7625ce7f2945f98ae81546e6611823.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Forecasting_Market_Direction_With_Put-Call_Ratios_Nov_2020-01-4e7625ce7f2945f98ae81546e6611823.jpg)