Llc Vs Corporation Chart

This entity comparison chart looks at taxation deductions membersshareholders and limited liability to help you decide.

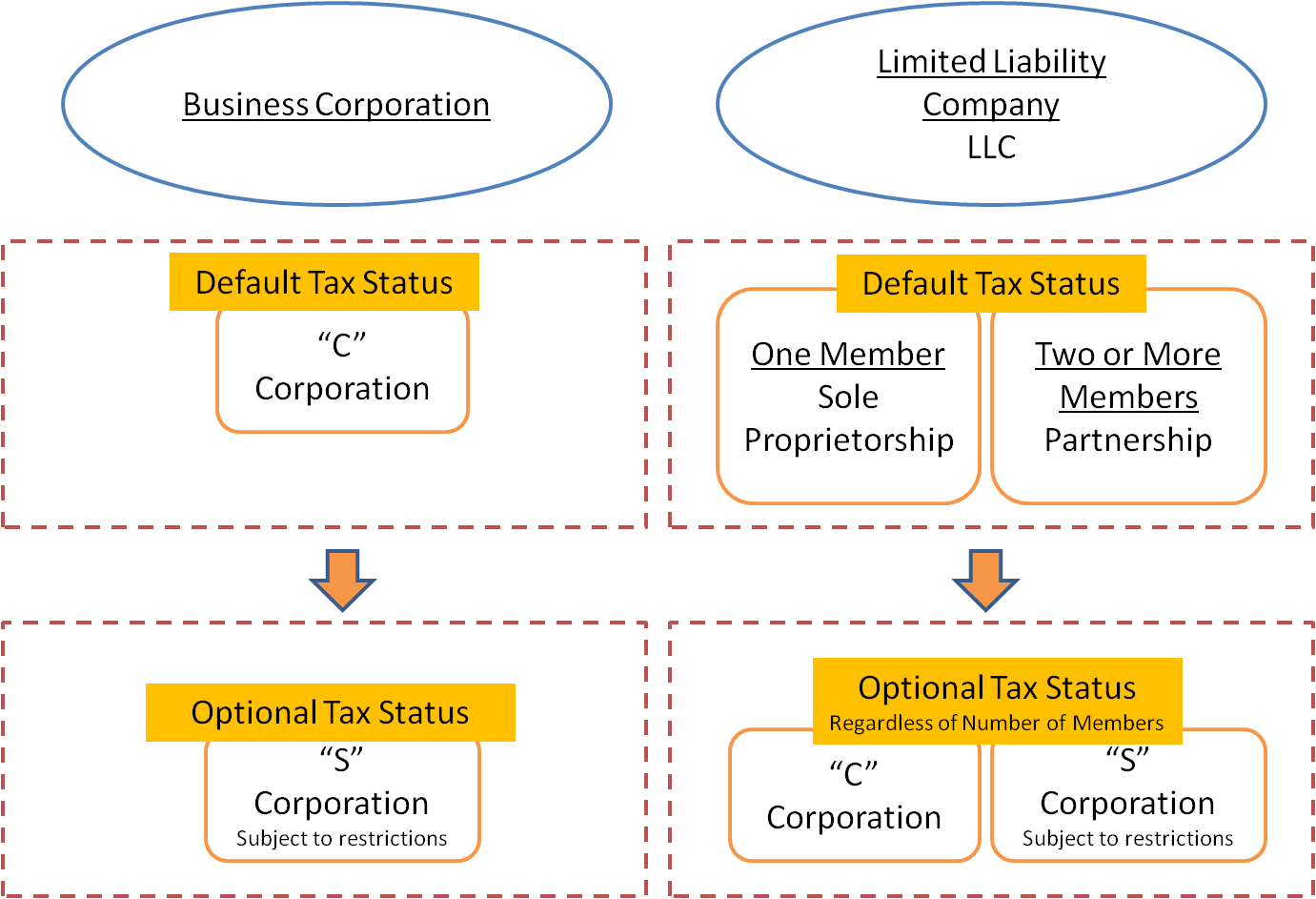

Llc vs corporation chart. Separate entity from owner. When you are forming an entity there are 5 key factors to keep in mind when choosing among LLCs S Corps C Corps. LLCs S Corps and C CorpsA Comparison Which entity type is right for you.

Legal paperwork involved Change to S corporation permitted by filing simple tax election. LLC vs LLP comparison. They share characteristics in common too however such as pass-through taxation.

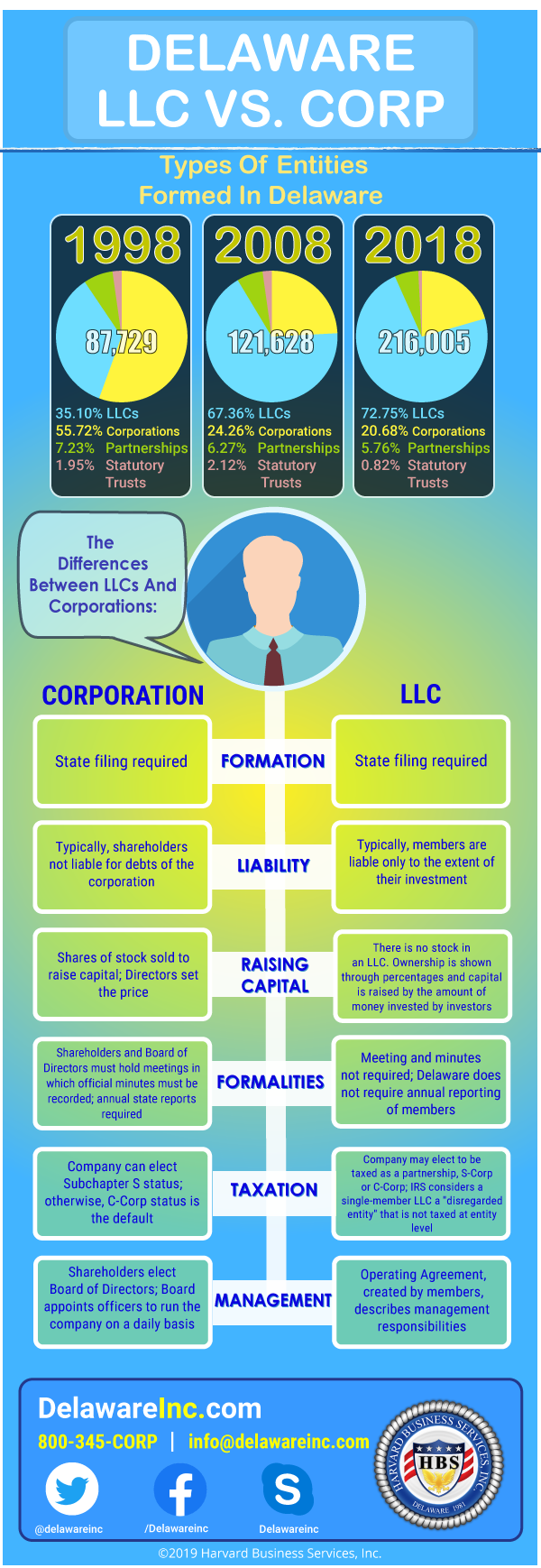

The entity itself is a legal person. This S Corporation vs. A business can be as small as a single person or it can be a multinational conglomerate.

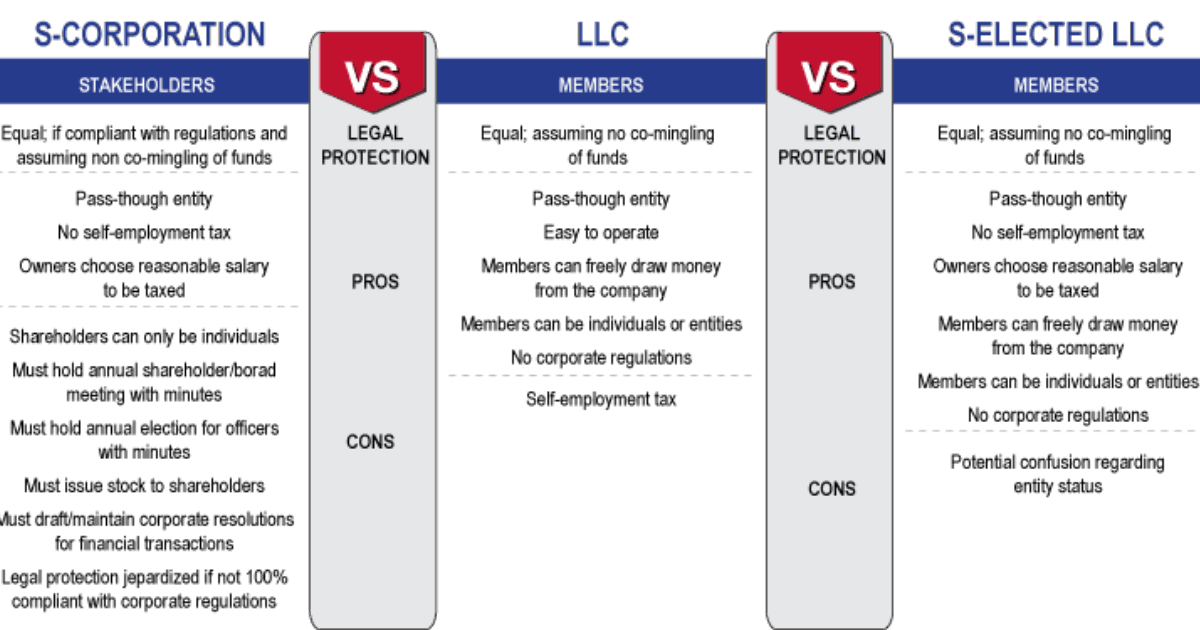

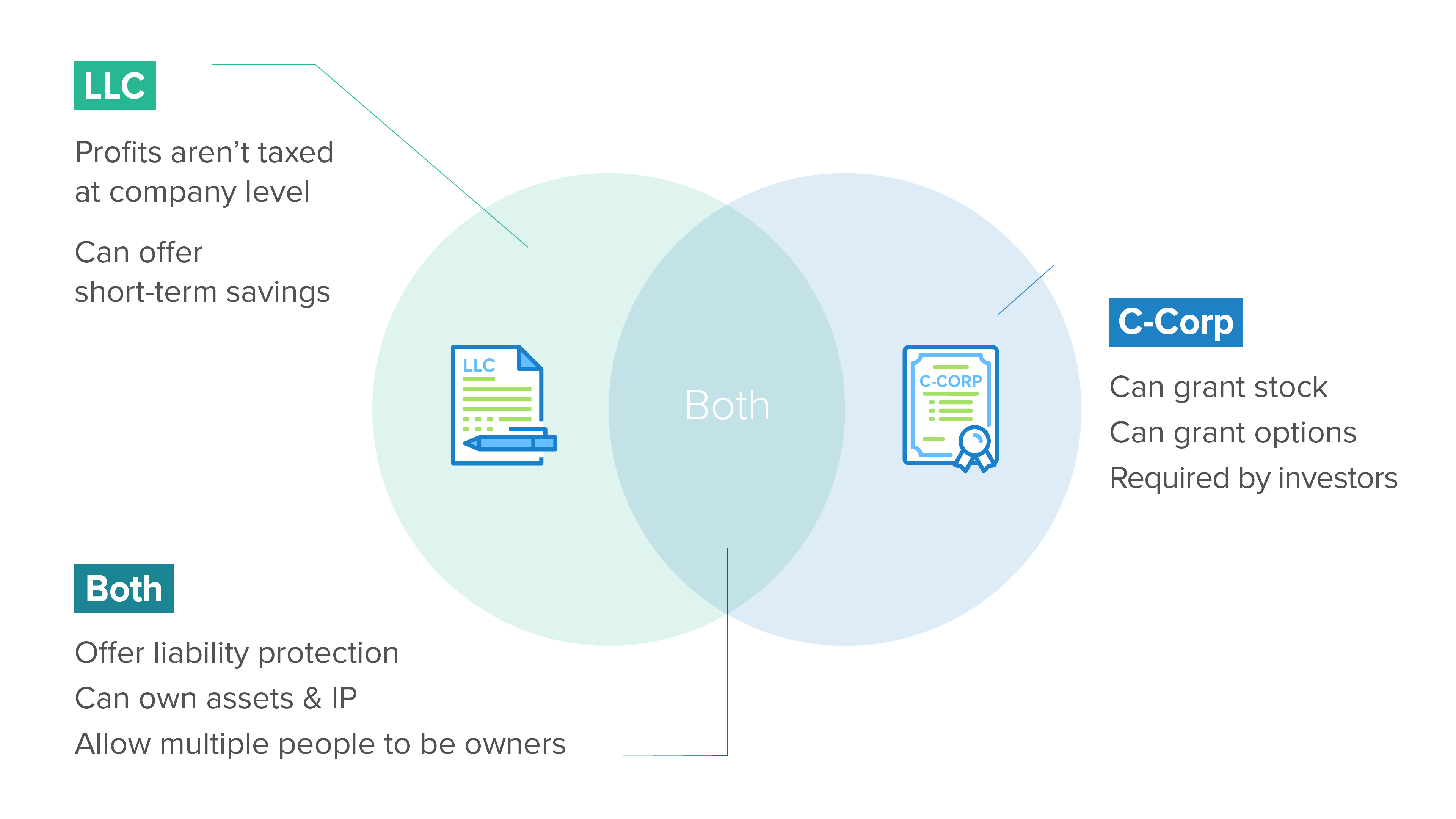

Separate Taxable Entity from Owner. LLCs and Corporations differ especially when it comes to things like ownership and structure. S corporations are required to pay a salary to owners who own more than 2 percent of the company and work there.

Use our business entity comparison chart to learn the differences between a Corporation Limited Liability Company Non-Profit Sole Proprietorship and more. The main difference between an LLC and a corporation is that an llc is owned by one or more individuals and a corporation is owned by its shareholders. Differences include restrictions on who can be the shareholders or owners of the company qualifications taxation and management requirements.

Separate entity from owner. The LL or limited liability in LLC is what protects your personal assets in the event of a judgment against your company. Skip to main content.

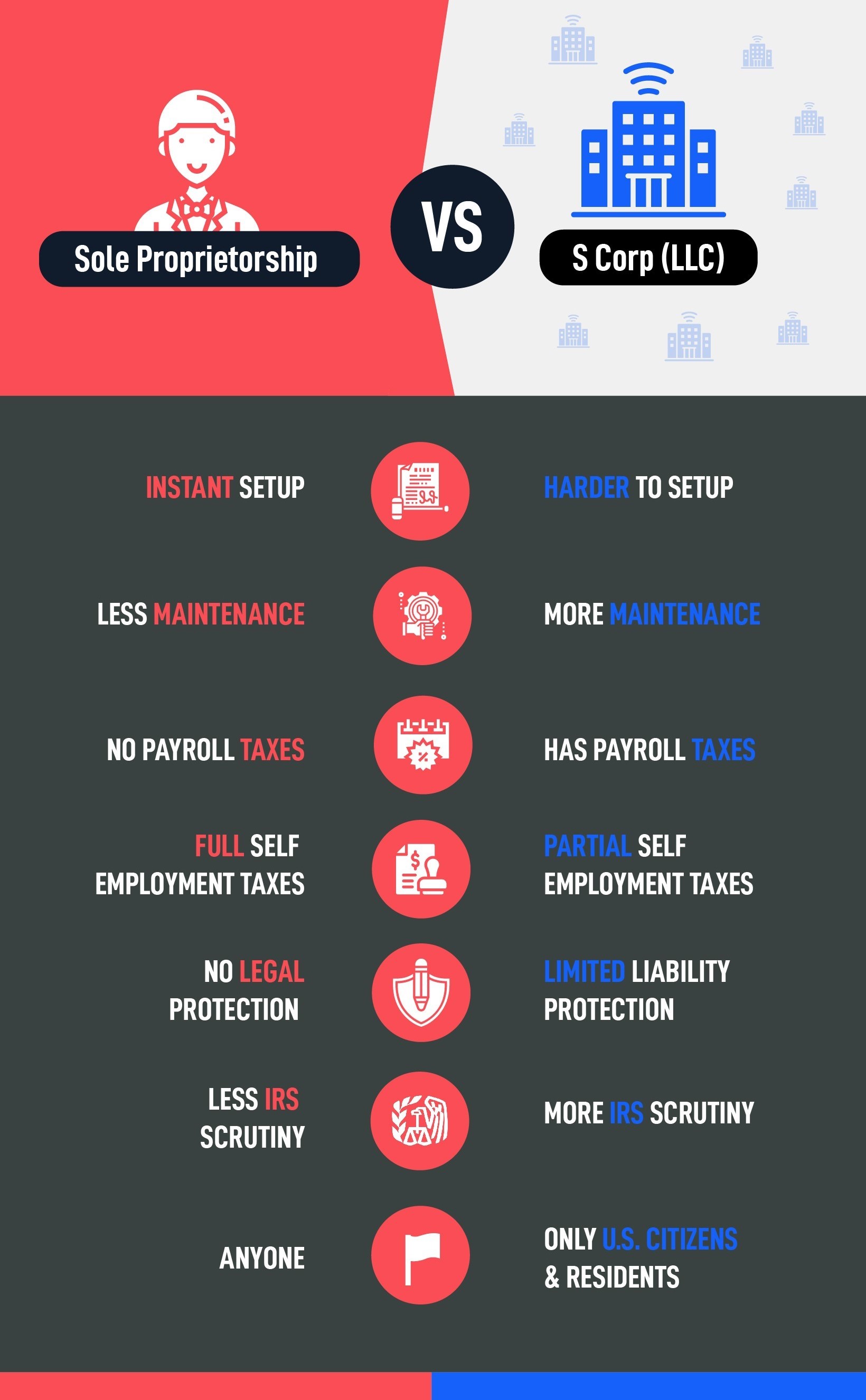

Change to LLC can involve tax costs and increased legal complexity Generally same as for C corporationit is possible to terminate S tax status to become C corporation but then S status cannot be elected again for five years. Same entity as owner. S corp business structures is important for every entrepreneur.

Learn more in this comprehensive guide. Corporation S corporation and C corporation as well as the advantages and disadvantages of each. Change to corporation or LLC permitted.

S Corps and limited liability companies are often confused as they are often discussed together even though they are talking about. Separate entity from owner. Incorporating a business allows you to establish credibility and professionalism.

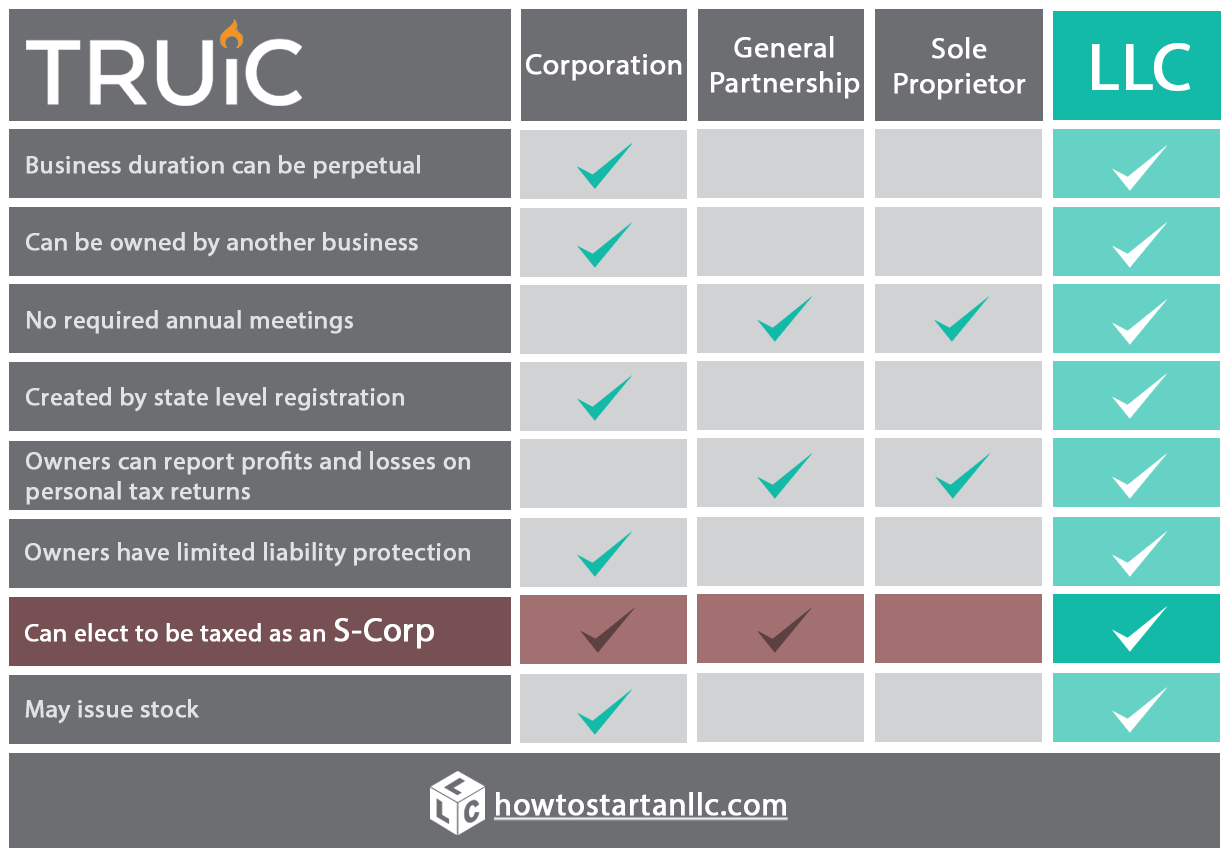

LLC ownership and management can be as simple or complex as the. And not every business qualifies as an LLC. Sole Proprietor Partnership C Corporation S Corporation LLC Legal Status.

This means all business. Ready to create your company. S Corporation vs C Corporation vs LLC See a quick comparison chart making it easier to understand the differences between an S Corp vs C Corp vs LLC.

Or LLC differ in their legal liabilities and business obligations and have some pros and cons when compared to other business organization structures like corporations partners. Compare business structures and decide which one is right for you. Limited liability companies enjoy pass-through taxes.

Each of these business types is incorporated meaning that an LLC S corp or C corp is a separate and distinct entity from the individual owners. S corporations are more restrictive on who the owners and shareholders can be. Learn about LLC vs.

No matter which entity you choose both entities offer big benefits to your business. Traditional corporations offer limited liability as well so lets focus on the structural and taxation differences to explain the differences of LLCs vs. Corporations in the chart below.

Use our business entity comparison chart to learn the differences between a Corporation Limited Liability Company Non-Profit Sole Proprietorship and more. A Limited Liability Partnership LLP and a limited liability company LLC. An LLC is also authorized by statute but it is a contract-centric entity.

Comparison Chart of the 7 Most Popular Business Structures. Call us at 8552364043 to get started. Understand the different tax treatments of each what is required to qualify for an S Corporation how to treat partners the advantages and disadvantages of each and what else you will need to start each entity.

S Corp Full Comparison - Pros Cons Form Your LLC or S Corp Today Hassle-free Quick When forming a business one of the biggest and most difficult decisions you are going to have to make is what business structure is best. However each starts out with basic paperwork. Comparing LLC vs.

A corporation a statutory entity that has different layers of ownership and management. Pick the best for you. There are plenty of options when it comes to.

This chart is intended for informational purposes only and may not include all aspects of tax. An S corp vs LLC chart shows the many similarities and differences between the two entities. Which to pick LLC vs Corporation.