Irs Appeals Process Flow Chart

Mail your appeal request directly to the IRS person or office that made the determination you seek to appeal.

Irs appeals process flow chart. Do you work through your own limited company or other intermediary. How to create an eSignature for the appeals internal revenue. The Internal Revenue Service Make IRSgov your first stop for your tax needs.

Contract is inside the off-payroll working rules IR35 You will be employed for tax purposes for that contract The party paying your limited company or other. Coronavirus COVID-19 Impact on Appeals Cases. IRS AUDIT FLOWCHART 2017 Roz Strategies.

Taxpayers can file appeal against the orders of assessing officer before the CITA having jurisdiction over the taxpayer. Get access to thousands of forms. Taxpayer files protest Nebraska Department of Revenue Department Refund Protest and Appeals.

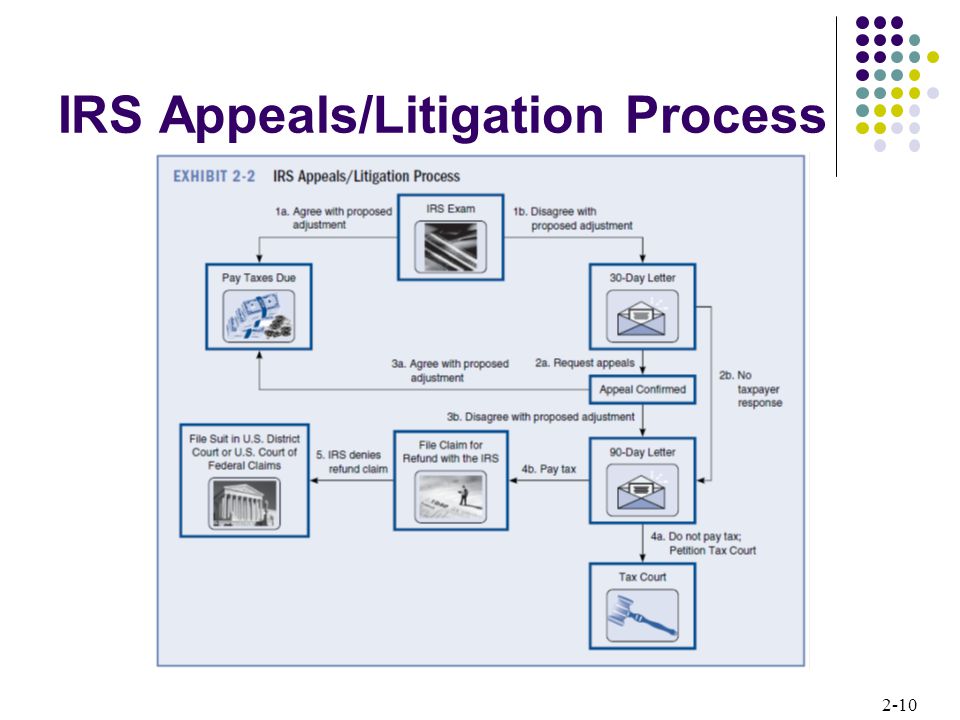

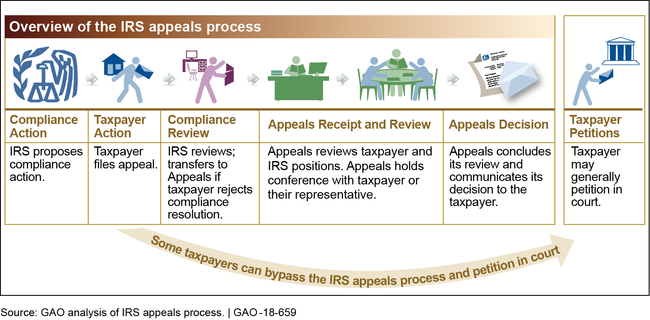

Service tax and income tax laws where it is explicitly allowed for an assessee to file for revision. The appeals process and available court actions are different. The IRS Independent Office of Appeals is here to resolve disputes without litigation in a.

In the case of sales tax assessed as a deficiency the taxpayer may pay the tax and file for a refund using the procedures on the left side of this flow chart. C On careful reading of definitions of adjudicating authority it clearly excludes the revisionary authority from its scope of coverage. Create this form in 5 minutes.

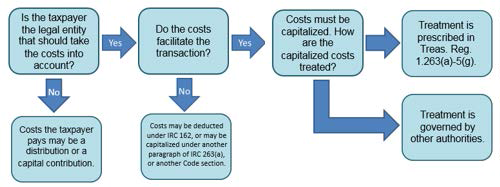

This means that going through the IRS Office of Appeals is often seen as a last resort for practitionersone that might seem intimidating. Below is a graphic representation of the property assessment appeal process for owners who believe their properties are incorrectly or unfairly assessed for tax purposes. 4-2021 Catalog Number 46074I Department of the Treasury Internal Revenue Service wwwirsgov This publication explains actions you should take prior to requesting an administrative appeal of your tax case if you dont agree with the Internal Revenue Services IRS proposed changes or.

Motion for reconsideration within which to file the appeal Neypes Doctrine FLOWCHART OF TAX REMEDIES by Pierre Martin D. You can find answers. Please see our latest update on In-person conferences.

Internal Revenue Service Appeals HQ NC Room 717 1111 Constitution Ave NW Washington DC 20224. 222012 100323 AM. A three-step process the IRS urges taxpayers choosing.

Appeals within IRS andor to the Courts Closing Agreement Your Exempt Organization is selected for examination. For additional information on the. Speed up your businesss document workflow by creating the.

A flow chart is presented below for better understanding-. However the chances of success of these appeals with the Circuit Courts are often quite low as the IRS has a 98 settlement rate and ordinarily settles losing cases long before going to Tax Court in. Understanding collection actions 4 Collection actions in detail5.

If paid within 10 business days 21 calendar days if less than 100000 no interest Installment Agreement OIC or other arrangement Appeal Ignore Formal Appeal Small Case Appeal Request. However sometimes the only way to get the best outcome is to go through Appeals and the process is often simpler than expected. This office does not process appeal requests.

Irs appeals process flow chart. Flowchart for contractors Am I affected by the changes to the off-payroll working rules IR35. For each stage in the tax process headings in the outline raise procedural questions identify procedural risks and describe procedural opportunities.

Use professional pre-built templates to fill in and sign documents online faster. The major shift in the appeal process at high court and above level is that some. With the Interactive Tax Assistant at IRSgovITA.

Federal Tax Lien5. If you have questions about your case contact your assigned Appeals Office by phone. Please dont hesitate.

EO Exam Flowchart appeals Author. Even though the Tax Court is commonly thought of as the forum of last resort for appealing tax bills and other IRS issues there is a way to appeal a Tax Court ruling. Appeal before a CITA can be filed only in the prescribed form number 35 and is to be accompanied by the proof of payment of prescribed appeal fee and original copy of the notice of demand issued by the assessing officer under.

TAX APPEALS 1. You can appeal through the State Board of Equalizations Website. If you dont pay on time.

In fact many seasoned CPAs have never taken a clients case to Appeals. We appreciate your patience and understanding during this time. This outline does not contain in-depth analyses of the procedural rules but does provide references to additional resources.

Within 30 days of the date the Appeals Office issues its written determination the taxpayer may seek review in the Tax Court or the appropriate Federal District Court5 The Tax Court is the proper forum for review if the underlying tax is of a type over which the Tax Court would normally have jurisdiction such as income gift and estate taxes6 Litigation will be in. How to appeal an IRS decision4. Reyes Page 1 of 11 I.

Assessments Section 228 NIRC OPTIONS OF TAXPAYER IF RECONSIDERATION 1. FLOWCHART OF TAX REMEDIES by Pierre Martin D. Pay tax due within 90 days.

DO NOT MAIL YOUR APPEAL REQUEST TO THIS ADDRESS. The first step depicted above Discuss the Value with the Assessor is not. REMEDIES UNDER THE NATIONAL INTERNAL REVENUE CODE A.