Income Tax History Chart

Under the Indian Income Tax Act of 1886 income was divided into four schedules taxed separately.

Income tax history chart. The normal tax rates applicable to a resident individual will depend on the age of the individual. Tax Years 1913 - 2018 Table 23 XLS. Government bonds typically paid five percent.

But the share of federal income tax paid has increased from 258 percent of all individual income taxes in 1986 to a 401 percent share of the total in 2007. Selected Income and Tax Items. Income Tax Department Income Tax Return Statistics Assessment Year 2015-16.

However in case of a non-resident individual the tax rates will be same irrespective of his age. The national debt consequently soared from 625 million to 7800 million. 1918- A new income tax was passed.

Altogether taxes provided at most 30 percent of national expenditures with the rest from borrowing. In Nominal Dollars Income. 891 KB Download toprate_historicalxlsx.

Appendix to Selected Historical and Other Data Tables. Number of Individual Income Tax Returns Income Exemptions and Deductions Tax and Average Tax by Size of Adjusted Gross Income. Individual Income Tax Returns.

Income Tax Department PAN Allotment Statistics Up to Financial Year 2016-17 as on 31-10-2017. Individual Income and Tax Data by State and Size of Adjusted Gross Income. The pressures of financing the war resulted in increasing customs and excise taxes and in 1916 the federal government began collecting corporation tax.

Normal tax rates for Individual HUF. 370142112019-TPL Dated 12-9-2019 following table should be used for the Cost Inflation Index -. Thus it is rising in comparison to currencies being printed.

Comparison of Personal Income in the National. Payable as income tax and surcharge shall not exceed the total amount payable as. This page provides - India Corporate Tax Rate - actual values historical data forecast chart statistics economic.

Corporate Tax Rate in India averaged 3375 percent from 1997 until 2021 reaching an all time high of 3895 percent in 2001 and a record low of 2517 percent in 2019. Look at the chart where in last 95 years price of 10 grams of gold is shown. Federal Individual Income Tax Rates and Brackets.

3 Interests on the securities of the Government of India. 4 Other sources of income. From the chart you can see that there is ups and down in the price of gold but ultimately it is beneficial to the investors.

NOTIFIED COST INFLATION INDEX UNDER SECTION 48 EXPLANATION V As per Notification No. Tax Rates DTAA v. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

Refer Tax Rates under Tax Charts Tables. Government needs revenue to finance war In 1917 as a temporary measure to help finance the war the federal government introduced the Income Tax War Act covering both personal and corporate income. The Indian Income Tax Act of 1918 repealed the Indian Income Tax Act of 1886.

The income tax rate grew to 5s 25 in 1916 and 6s 30 in 1918. 2 Net profits of companies. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

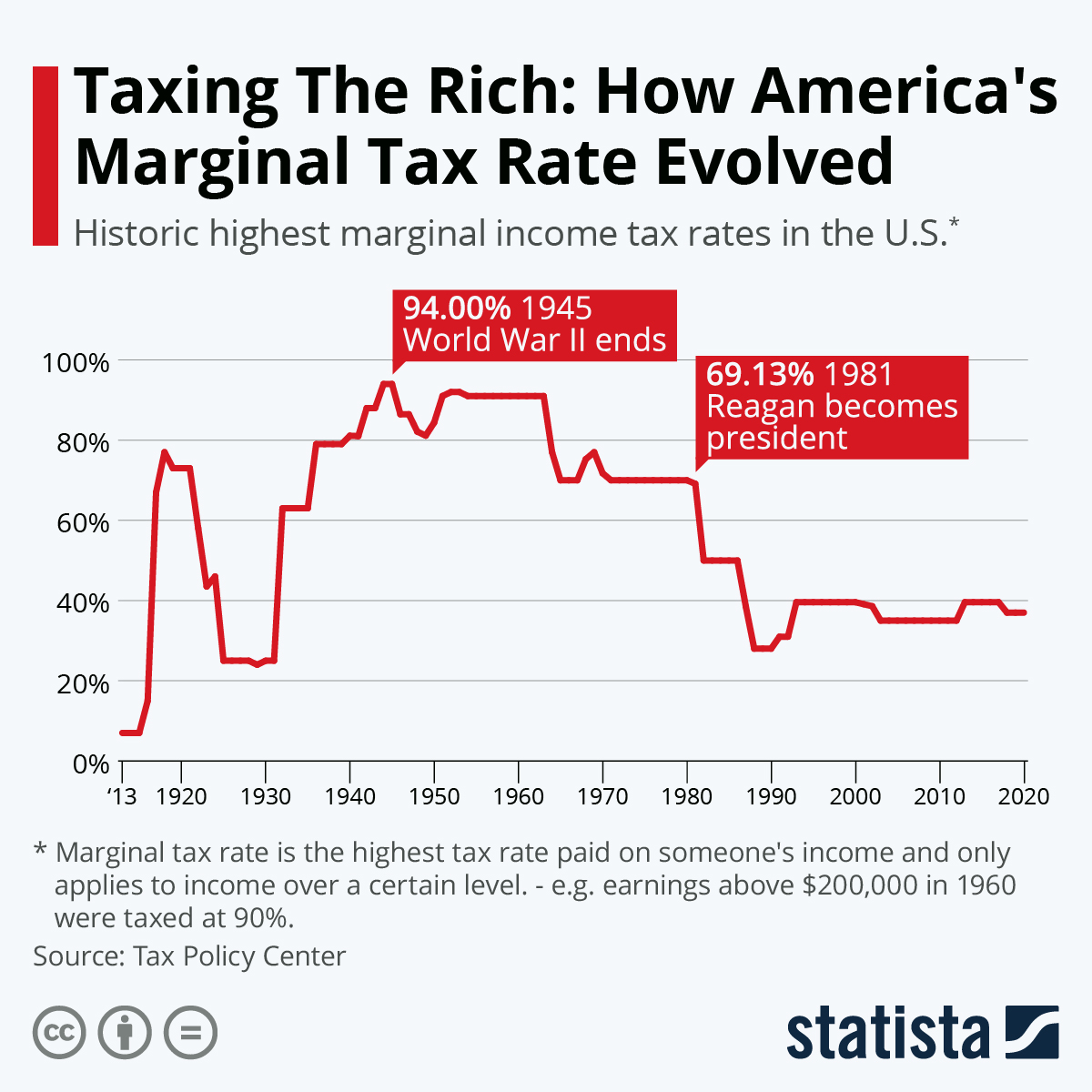

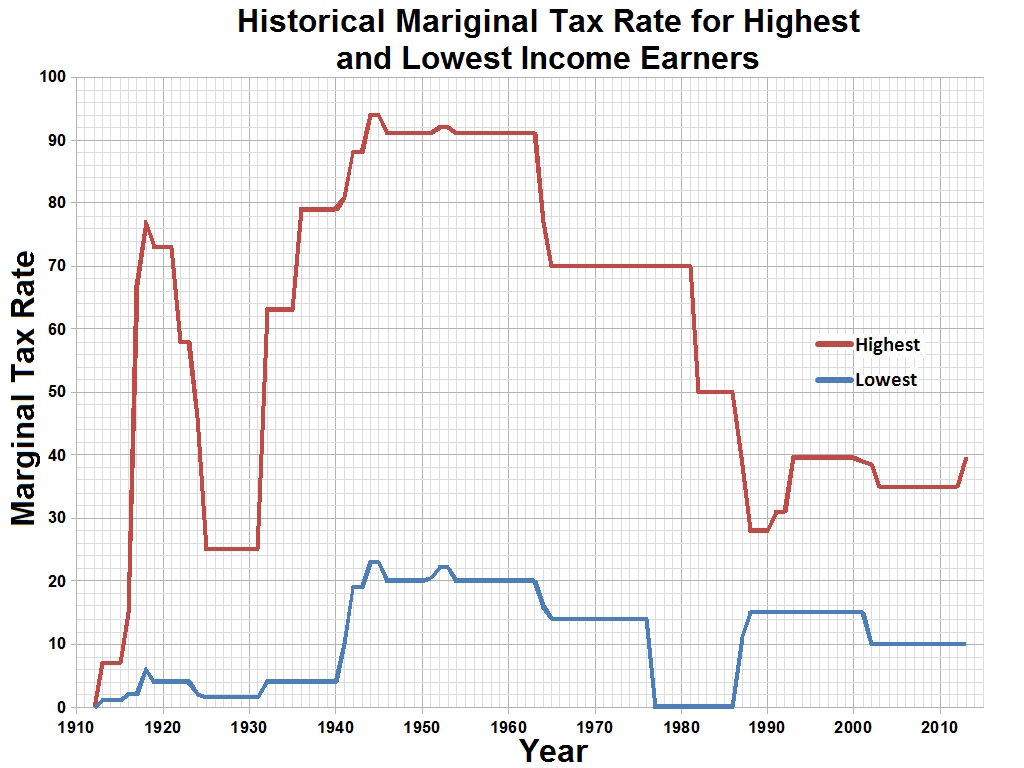

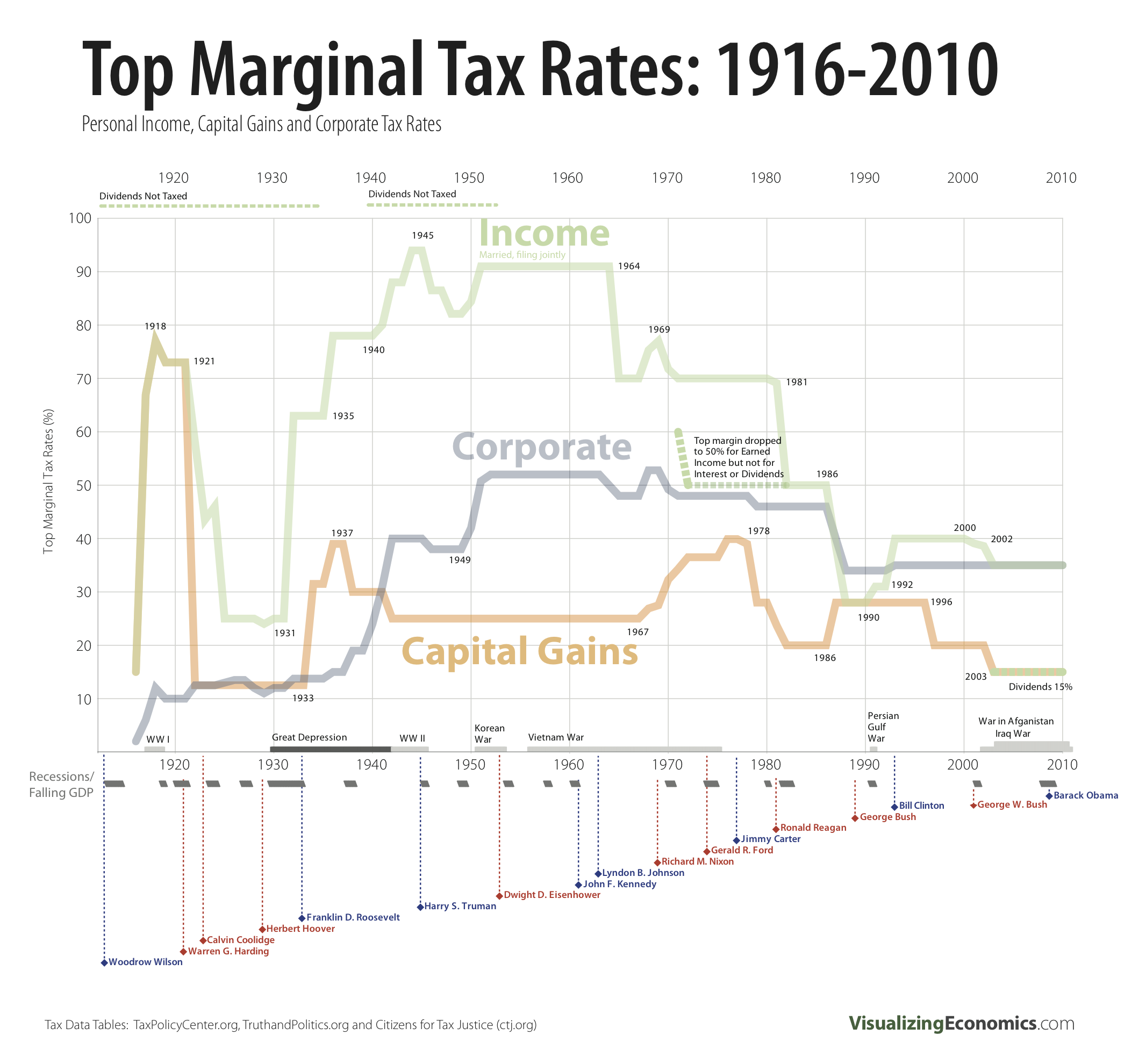

Income Tax Department Time Series Data Financial Year 2000-01 to 2016-17. Historical highest marginal personal income tax rates 1913 to 2020. Certain income of non-resident inter-alia dividend interest royalty or fees for technical services shall be taxable as per the rates prescribed under the Income-tax Act or as per the rates prescribed under the DTAAs whichever is more beneficial to such non-resident.

Federal Individual Income Tax Rates History Nominal Dollars Income Years 1913-2013 Nominal Married Filing Jointly Married Filing Separately Single Head of Household Marginal Marginal Marginal Marginal Tax Rate Over But Not Over Tax Rate Over But Not Over Tax Rate Over But Not Over Tax Rate Over But Not Over 100 0 17850 100 0 8925 100 0 8925. Income Tax Department PAN Allotment Statistics Financial Year 2013-14. Gold cannot be printed.

13 rows Historical US. Corporate Tax Rate in India remained unchanged at 2517 percent in 2021 from 2517 percent in 2020.