Income Based Repayment Chart

Fixed rates range from 269 APR to 614 APR excludes 025 Auto Pay discount.

Income based repayment chart. Income-Based Repayment IBR if you took out your first. 4 rows Income-Based Repayment IBR 10 of discretionary income if you borrowed on or after July 1. For graduate loans forgives Direct LoanFFEL Loan balance after 300 monthly payments.

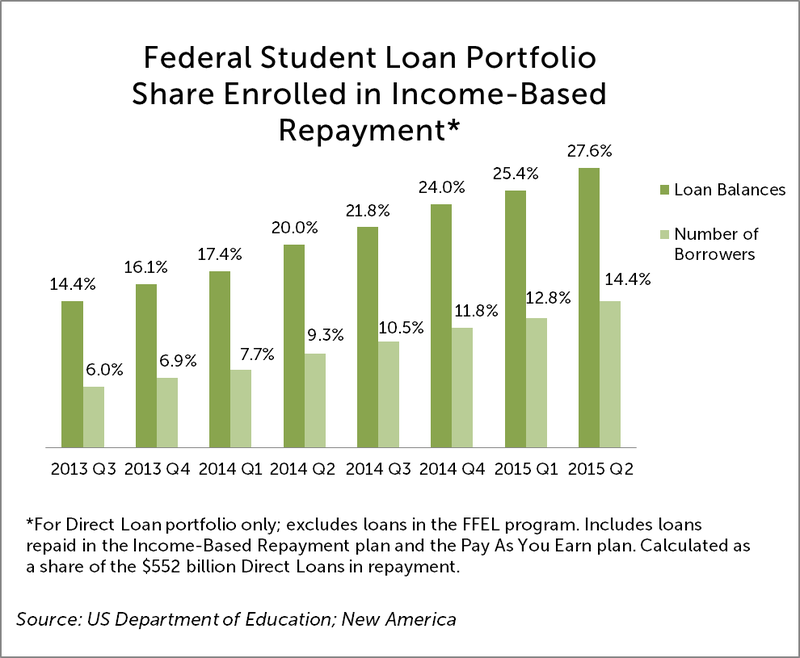

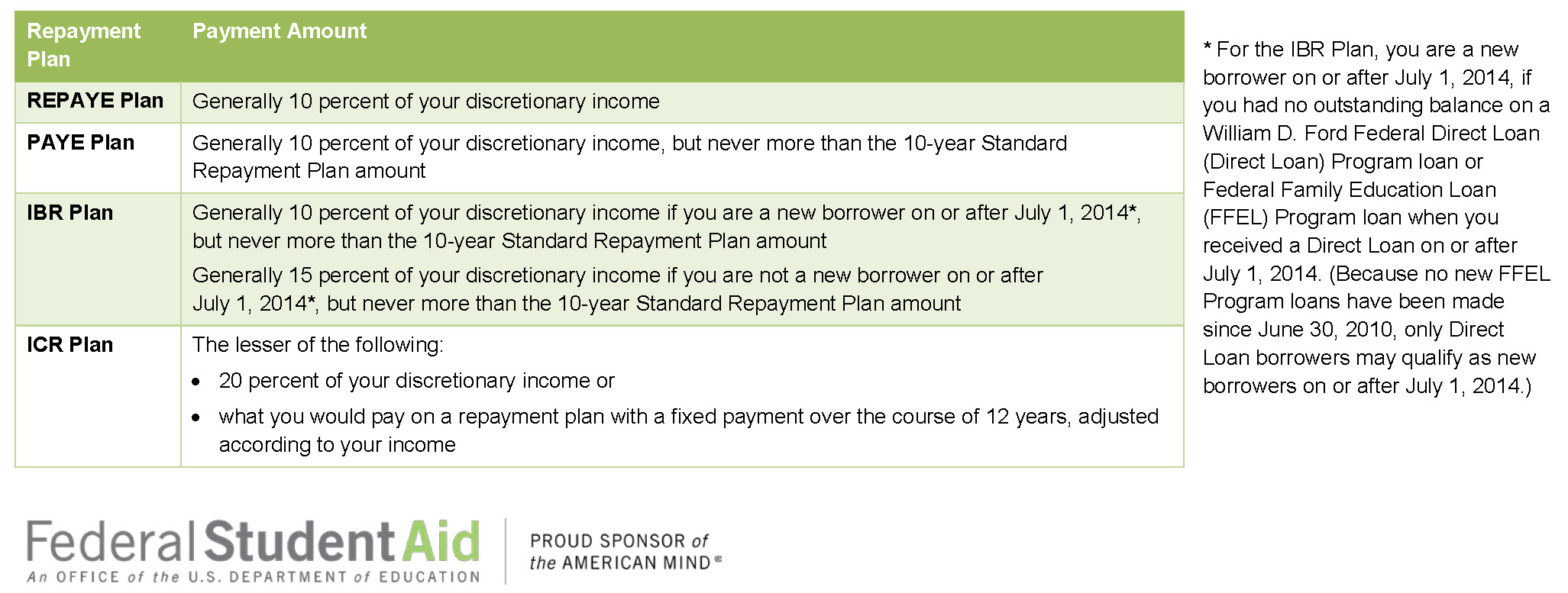

Using the calculator above we can see how the Income-Based Repayment Plan can help a borrower who needs some relief from monthly student loan payments. Depending on the plan you choose you will pay a maximum of 10 15 or 20 of your monthly discretionary income. Federal Student Aid.

Income-Based Repayment IBR is available to federal student loan borrowers and helps make your monthly student loan payments more manageable. Loan Simulator helps you calculate student loan payments and choose a loan repayment option that best meets your needs and goals. Income-Based Repayment IBR A lot of people confuse Income-Driven Repayment IDR with Income-Based Repayment IBR.

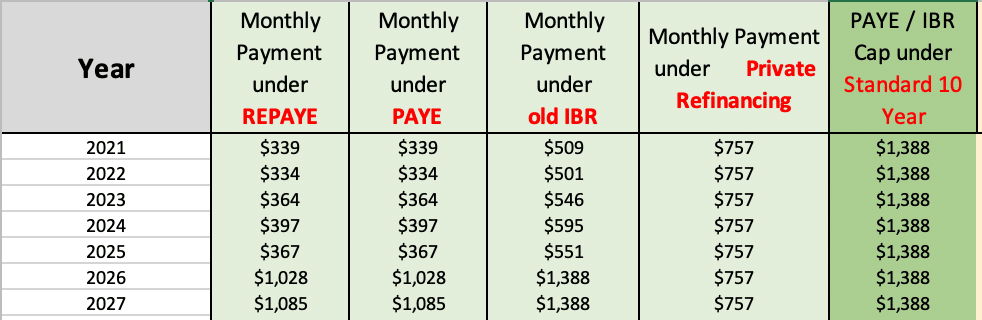

The date when you became a new. For the Revised Pay As You Earn REPAYE Pay As You Earn PAYE Income-Based Repayment IBR and Income-Contingent Repayment ICR plans under the William D. Discretionary income uses a standard formula using several factors.

The loan type and interest rate are preset. Forgives Direct Loan balance after 240 monthly payments 20 years. Earnest variable interest rate student loan refinance loans are based on a publicly available index.

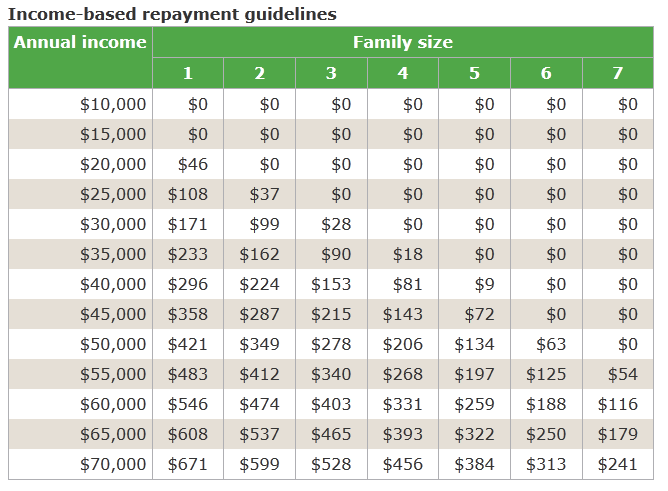

5 rows 10 of discretionary income. Under these plans your monthly payment is based on your income and family size. Income-driven repayment uses your household income and household size to determine how much you can afford to pay.

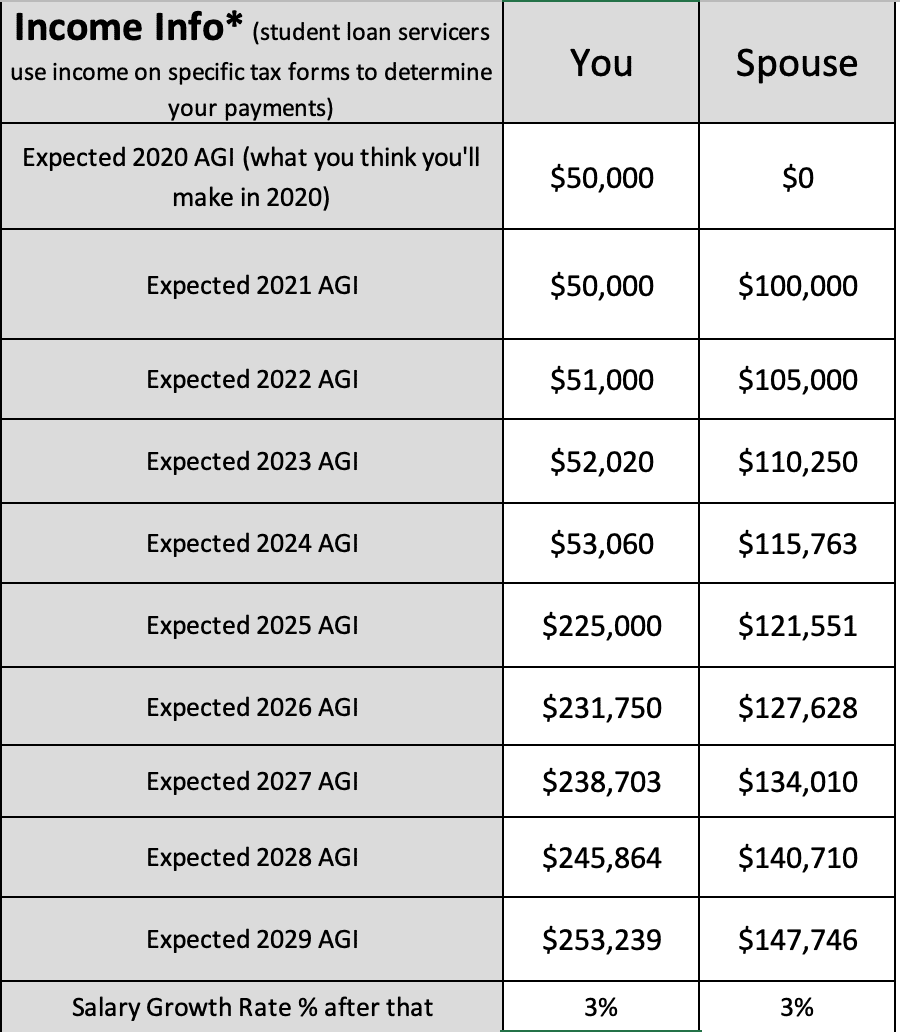

Resident with a one-member family adjusted gross income of 50000 and 50000 in student loan debt could reduce their monthly payment by 162 with IBR. INCOME-DRIVEN REPAYMENT IDR PLAN REQUEST. There is no minimum monthly payment.

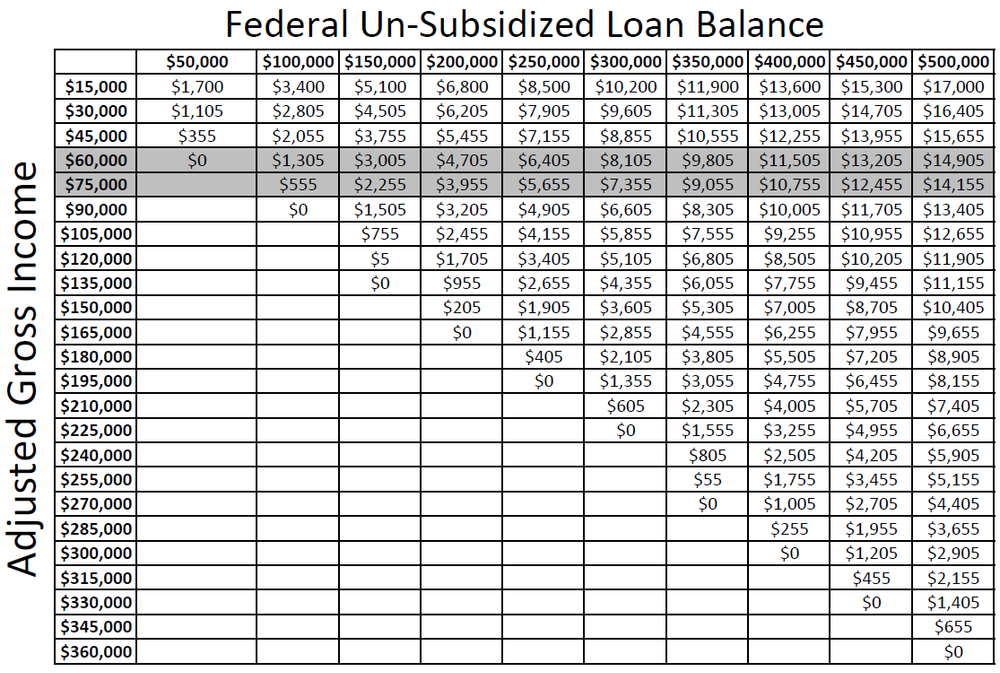

However you can change them. Plug in some numbers and see how much you can save under IBR. See Your Federal Student Loan Repayment Options with.

So whats IBR all aboutIBR sets up your monthly student loan payments based on two factors. Variable rates range from 199 APR to 599 APR excludes 025 Auto Pay discount. When applying for IBR the government looks at your income family size and state of residence to calculate your monthly payments.

When entering dollar amounts do not use commas or decimals. Income-Based Repayment IBR caps your monthly payment at 15 of your discretionary income and offers forgiveness after 25 years of qualifying payments. Enter your loan information amounts and interest rates in the calculator below to estimate your monthly payment amount under the income-based repayment plan.

Income-driven repayment plans can help lower your monthly student loan payment. You can also use it to decide whether to consolidate your student loans. Ford Federal Direct Loan Direct Loan Program and Federal Family Education Loan FFEL Programs.

An individual who is a Washington DC. Remember that IDR is the general term for these plans while IBR is a specific type. IDR plans include Revised Pay As You Earn REPAYE Pay As You Earn PAYE Income-Based Repayment IBR and Income-Contingent Repayment ICR Plans.

For undergraduate loans forgives Direct Loan balance after 240 monthly payments 20 years.