How Long To Keep Documents Chart

If we picked your house at random for an impromptu inspection of your financial filing system would we find a streamlined filing cabinet or one that was overrun with paper clutter.

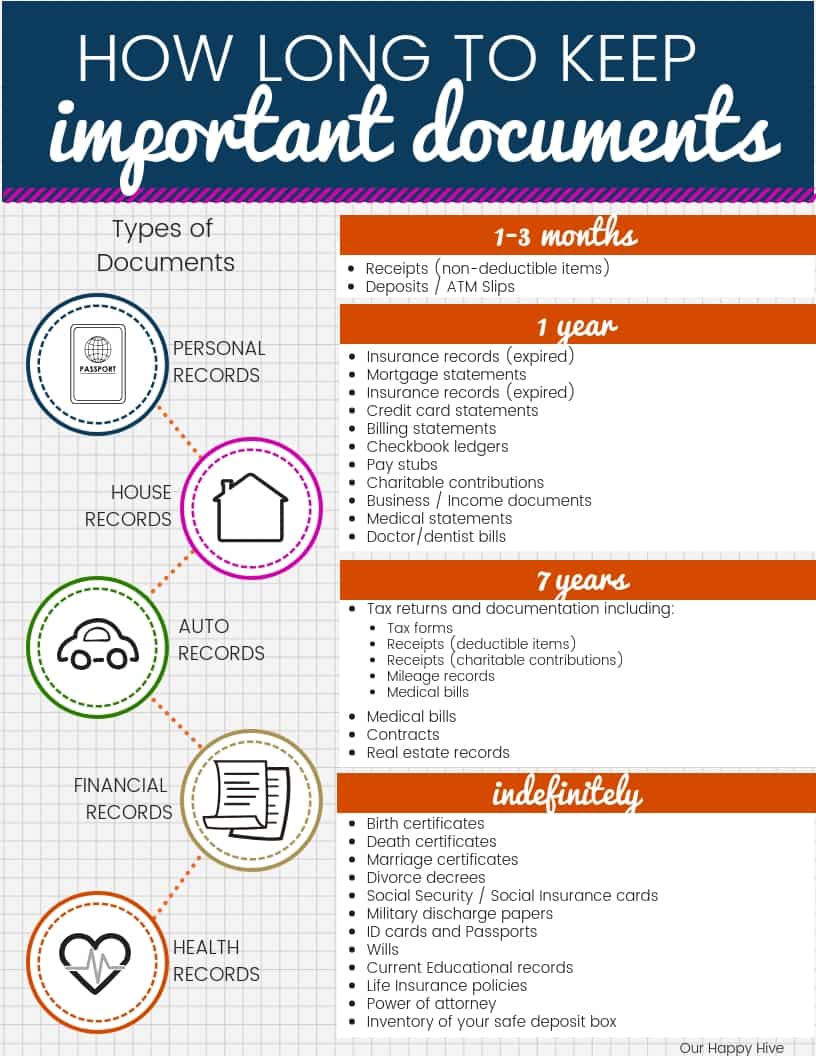

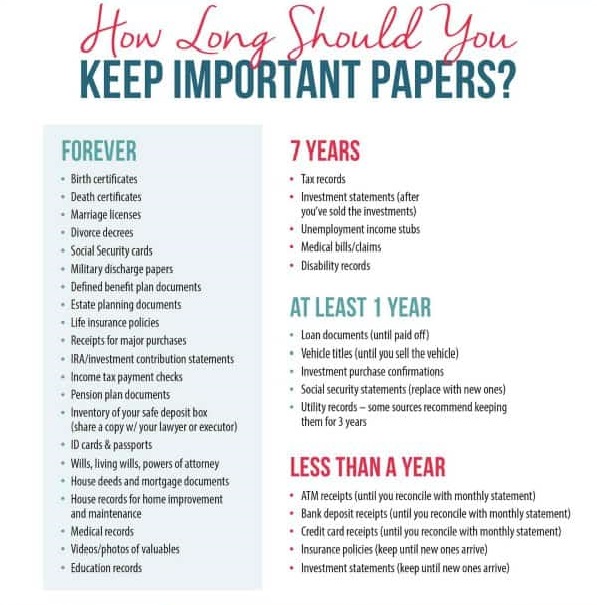

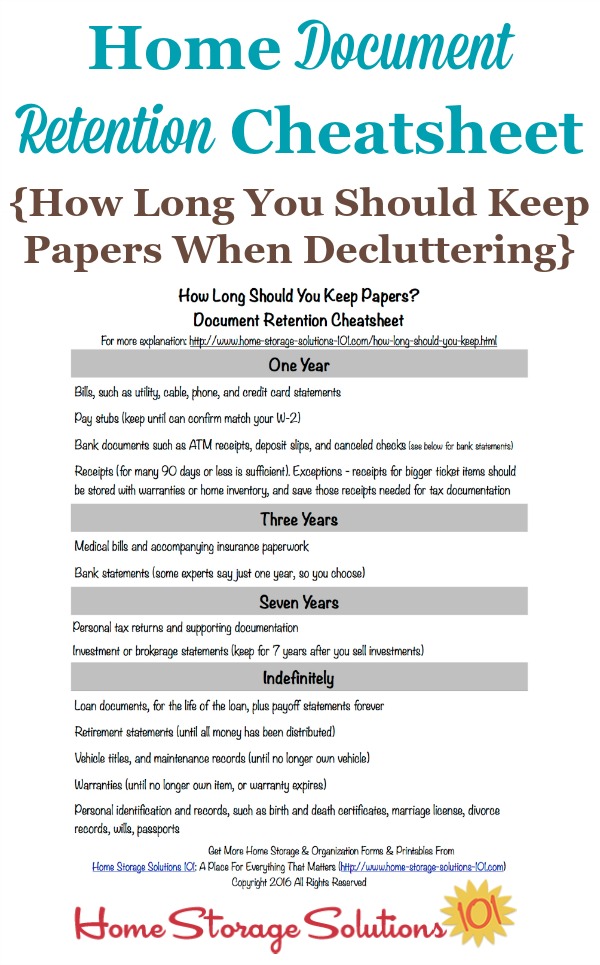

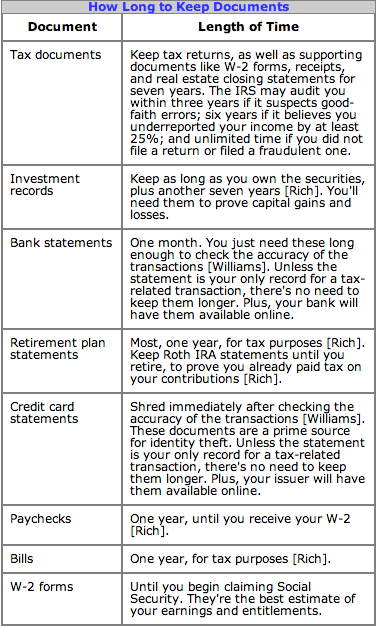

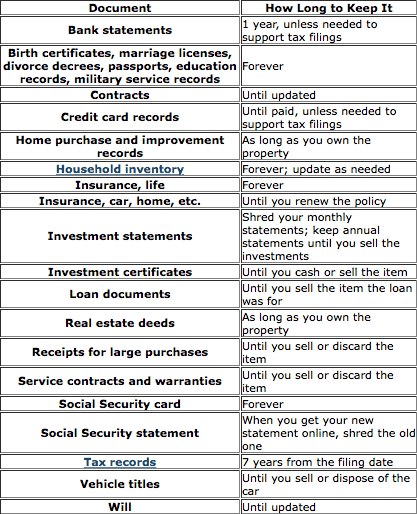

How long to keep documents chart. Chart 1 lists records and important papers typically needed and why they are important. Keep credit card statements for 60 days unless they include tax-related expenses. No limit exists if you failed to file or filed a fraudulent return.

The IRS may go back 7 years to audit your tax returns for errors or incorrectly claimed deductions so its important that you keep all tax-related documents for that length of time. This limit can increase to six years if the agency believes you under-reported income by more than 25. Its a good idea to keep your digital copies stored online if you choose to go paperless.

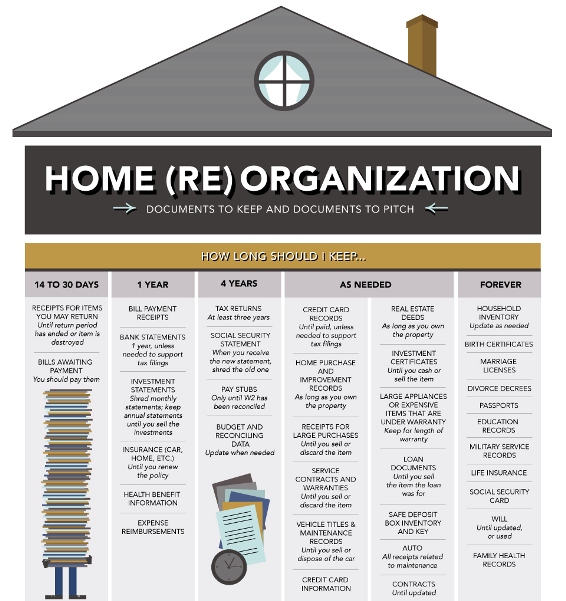

Always check with your attorney accountant and the IRS for updates and changes. Use this handy chart to find out how long you should be keeping financial documents like tax returns and annual retirement account statements. How Long To Keep Documents Chart.

Records of Satisfied Loans What to hold while active. Receipts Cancelled Checks and other Documents that Support Income or a Deduction on your Tax Return Keep 3 years from the date the return was filed or 2 years from the date the tax was paid -- which ever is later Annual Investment Statement Hold onto 3 years after you sell your investment What to keep for 7 years. Hire an accountant or business manager to help.

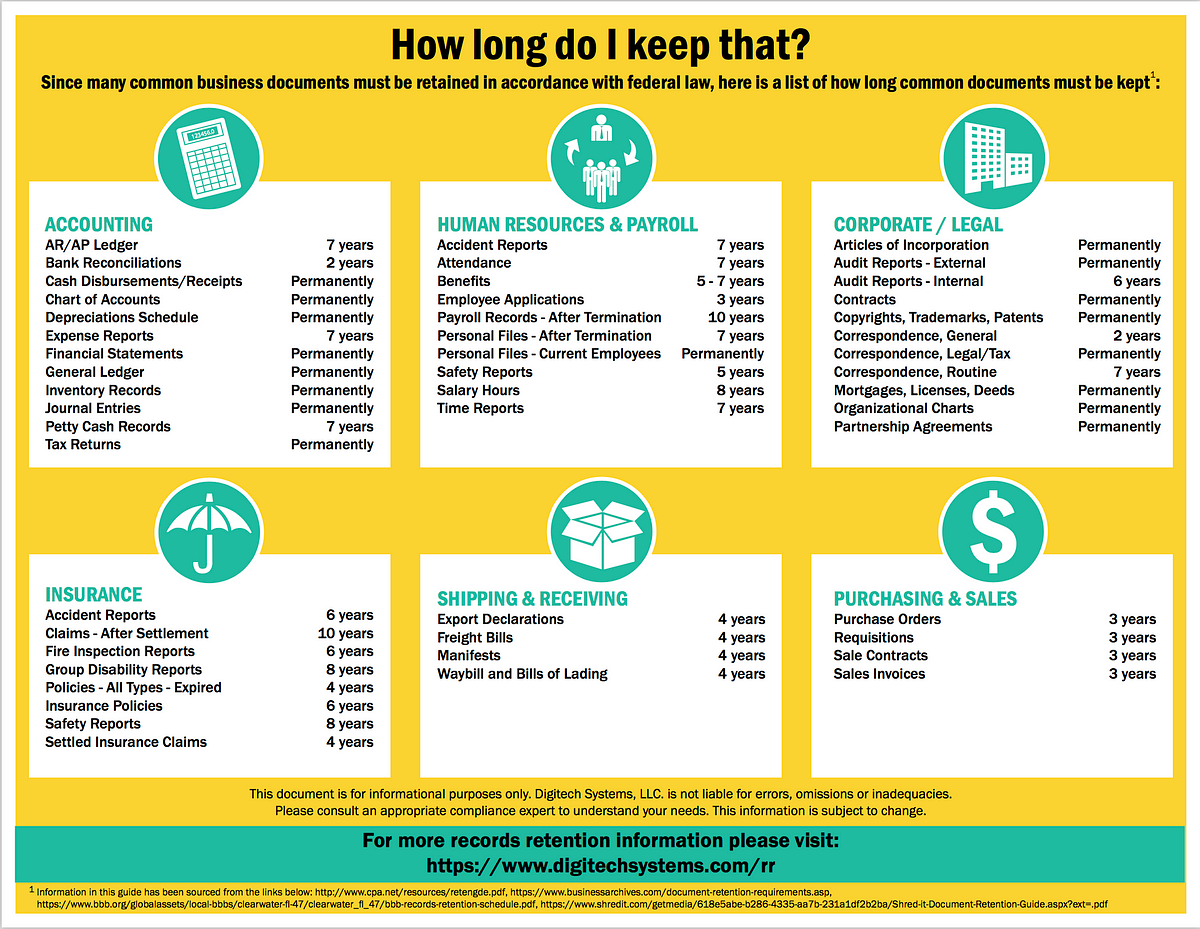

Chart of accounts Permanently. W-2 and 1099 forms. You should keep this document for at least seven years for your tax records.

Personnel and payroll records. Electronic payment records 7 years. So thats a look at how long to keep certain documents.

Because every household may. Employee expenses reports 7 years. It is generally advised to keep tax returns for 3-10 years depending on your financial and tax situation.

Free printable checklist. As such it is wise to keep tax records for at least seven years after a return is filed. Regardless of how records are stored regular filing and review of documents is important.

Keep records for 6 years if you do not report income that you should report and it is more than 25 of the gross income shown on your return. Keep either a digital or hard copy of the past years worth of your monthly bank and credit card statements. Dont feel bad if you are in the latter camp.

Keep records indefinitely if you do not file a return. In this case you should hold onto them for 3 years. Posted by Sarah on March 8 2012 print article e-mail to a friend.

KEEP 3 TO 7 YEARS Knowing that a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099 bank and brokerage statements tuition payments and charitable donation receiptsfor three to seven years. However if you have the space its a good idea to hold onto it forever so that you can prove the loan is paid off. Keep until reconciliation at the end of the year or at tax time.

But some documents can be destroyed much quicker after they come into your life. General journal Permanently. If paperwork isnt your strong point dont be an ostrich.

Title 2 Information is any individual fact or content number image or sound and can be held or used in any format. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Depreciation schedules Freight bills and bills of lading 7 years.

Documents to Keep for 7 Years. To be more conservative you can keep the supporting documents for 7 years and then simply keep the tax return for 7-10 years. Making the decision on when to discard old files is often difficult.

The IRS generally has three years to examine your return. Hold on to annual statements until you sell the investments. Fixed asset record invoices cancelled checks Permanently.

How long to keep financial records. Shred monthly and quarterly statements as new ones arrive. Theres no good answer for everything but recommended guidelines based on what it is.

How Long To Keep Important Information Organizational Guide Author. Regular statements pay stubs. Deeds mortgages bi lls of sale Permanently.

The chart also provides guidelines on how long records should be kept. Receipts for tax purposes.