Accounting Debits And Credits Chart

When cash is paid out credit Cash.

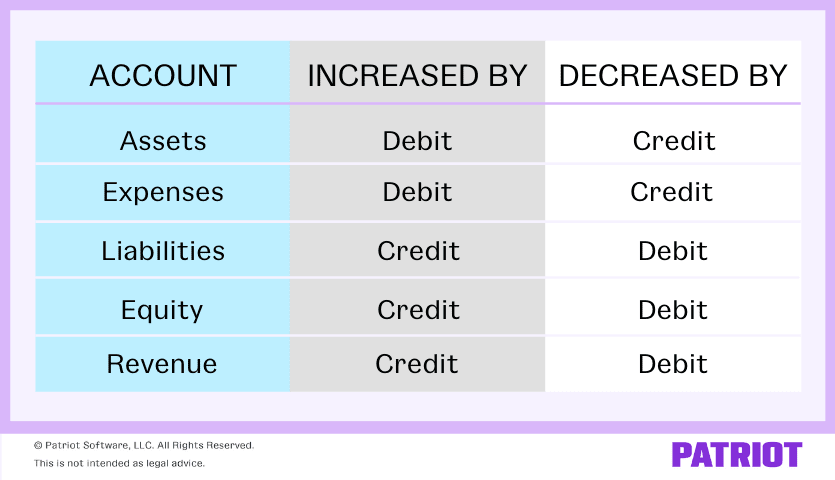

Accounting debits and credits chart. When cash is received debit Cash. Asset accounts normally have DEBIT balances. To reduce the asset Cash the account will need to be credited for 2000.

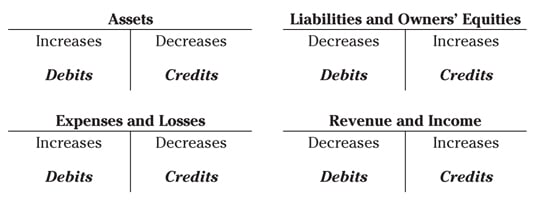

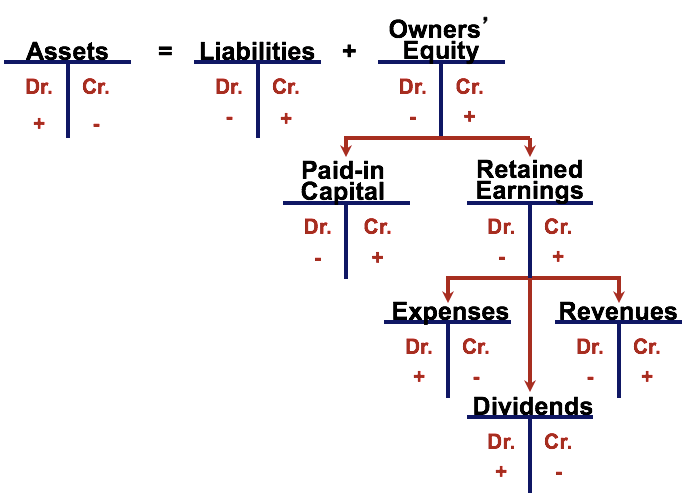

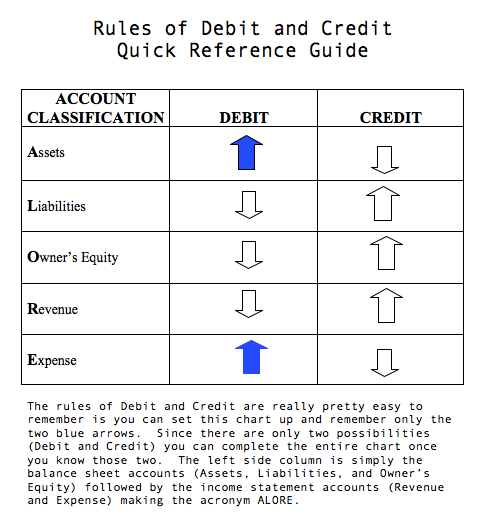

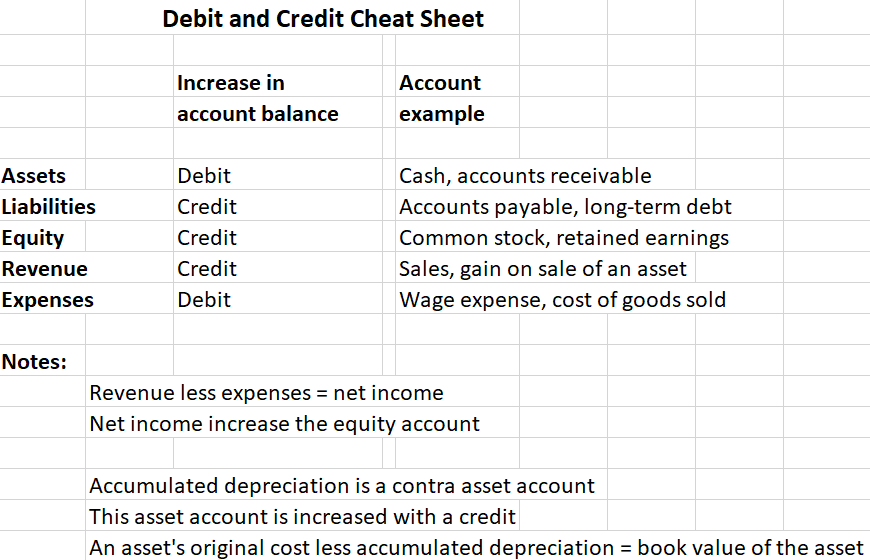

The chart shows the normal balance of the account type and the entry which increases or decreases that balance. Accounting Cycle Page 2 of 9 Step 1 Business transactions occur that result in source documents such as. DEBITS CREDITS _____ ASSETS LIABILITIES EQUITY DEBITS CREDITS.

Debits dr record all of the money flowing into an account while credits cr record all of the money flowing out of an account. In bookkeeping classes they always start with a T account. A credit does the opposite.

Accounting Cycle Page 1 of 9 Journal Entries Adjusting Entries Closing Entries Balance Sheet and Income Statement Starts here. After entering the debits and credits the T-accounts look like this. Every transaction affects two accounts or more.

The Debits and Credits Chart below acts as a. What are debits and credits. When you deposit money in your bank account you are increasing or debiting your Checking Account.

Double-Entry Accounting Debits Credits The Journal The Ledger. In a trial balance revenue credits will appear as negative numbers in brackets such as 1000000 of revenue and expenses will appear as positive numbers such as 200000 of expense. When you write a check you are decreasing or crediting your Checking Account.

For further details of the effects of debits and credits on particular accounts see our debits and credits. At least one account will be debited and at least one account will be credited. If you have a debit it goes on the left side of the line in the T and if you have a credit it goes on the right side of the line in the T.

5 rows In this journal entry cash is increased debited and accounts receivable credited decreased. Under this system your entire business is organized into individual accounts. Beyond Balanced Books Bookkeeper S Cheat Sheet.

You should be able to complete the debitcredit columns of your chart of accounts spreadsheet click Chart of Accounts. The total of the amounts entered as debits must equal the total of the amounts entered as credits. A debit entry increases an asset or expense account or decreases a liability or owners equity.

As a result the companys asset Cash must be decreased by 2000 and its liability Notes Payable must be decreased by 2000. It also shows you the main financial statement in which the account appears the type of account and a suggested nominal code. Thus debit entries are always recorded on the left and credit entries are always recorded on the right.

If you will notice debit accounts are always shown on the left side of the accounting equation while credit accounts are shown on the right side. Next we look at how to apply this concept in journal entries. Regardless of what elements are present in the business transaction a journal entry will always have AT least one debit and one credit.

So debits and credits dont actually mean plusses and minuses. Debit And Credit Cheat Sheet Rules For Debit Credit Accounting. Debits and Credits Chart Using the Bookkeeping Debits and Credits Chart The Debits and Credits Chart below acts as a quick reference to show you the effects of debits and credits on an account.

Debits are always on the left side of the journal entry and credits on the right. If theyre not equal youve probably made a mistake. Sample Chart Of Accounts For A Small Company Accountingcoach.

Accounting Debits And Credits Chart Electronic Presentations In. Debits And Credits Chart Unique Solved Fill In Charts With Correct. Happiness for an accountant is when debits equal credits.

On June 2 2020 the company repays 2000 of the bank loan. The Debits and Credits Chart below acts as a quick reference to show you the effects of debits and credits on an account. Most businesses these days use the double-entry method for their accounting.

Video result for Debit And Credit Chart. What does that mean. 148 rows Using the Bookkeeping Debits and Credits Chart.

Accounting Debits Credits Chart of Accounts.

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)